1040 Printable Tax Form - Federal income taxes due are based on the calendar year january 1, 2022 through december 31, 2022. Department of the treasury—internal revenue service. All forms are printable and downloadable. Irs use only—do not write or staple in this space. Go to the input return tab. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Individual tax return form 1040 instructions; Web printable federal income tax form 1040. Select deductions from the left menu, then itemized deductions (sch a). Once completed you can sign your fillable form or send for signing.

Electronic IRS Form 1040NR 2018 2019 Printable PDF Sample

You only received a w2. They are due each year on april 15 of the year after the tax year in question. Web information about form 1040, u.s. Individual income tax return, including recent updates, related forms and instructions on how to file. Web for the 2022 tax year, federal tax form 1040, us individual income tax return, must be.

Irs 1040 Form Example 1040 Ez Nr Form Example 1040 Form Printable

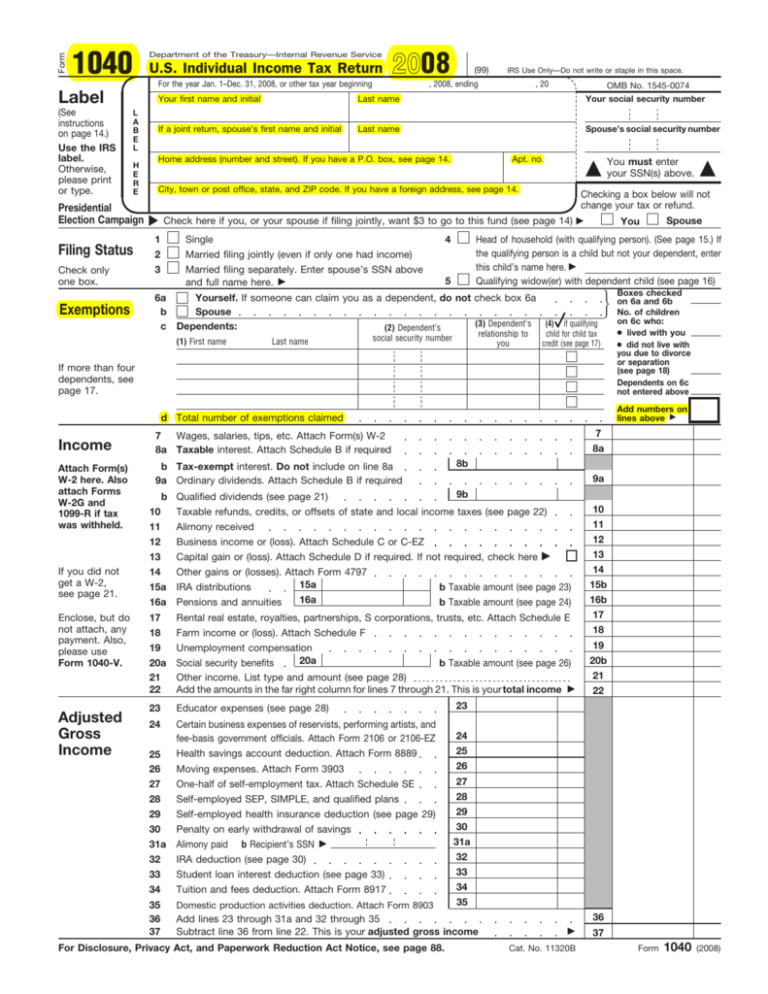

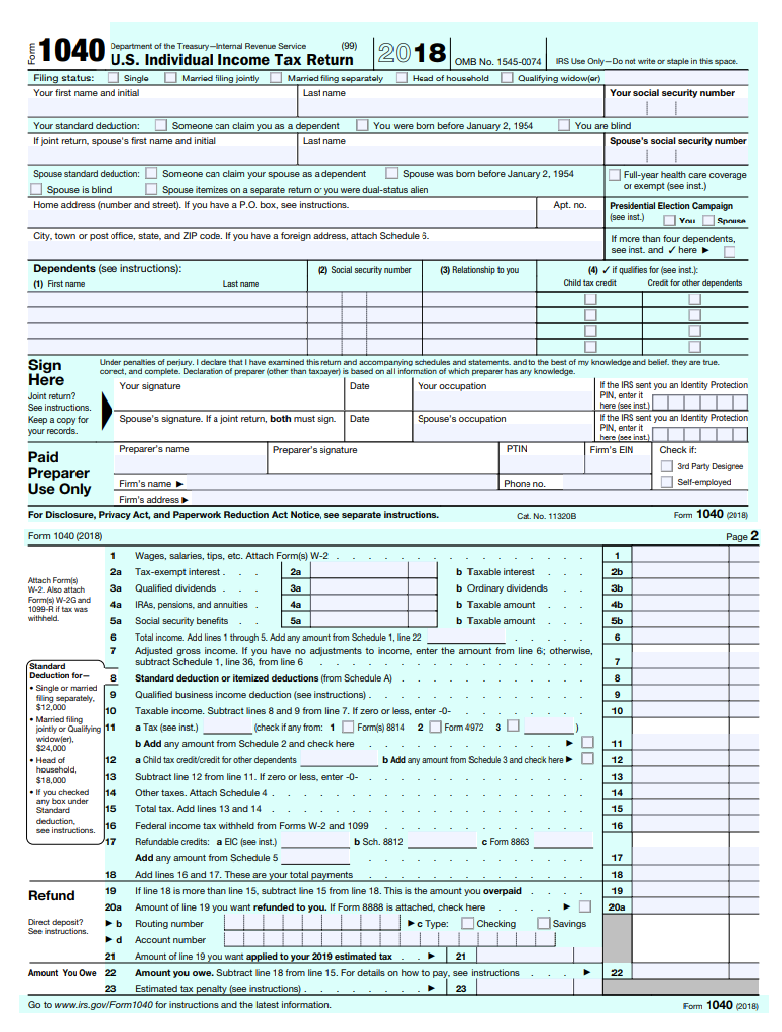

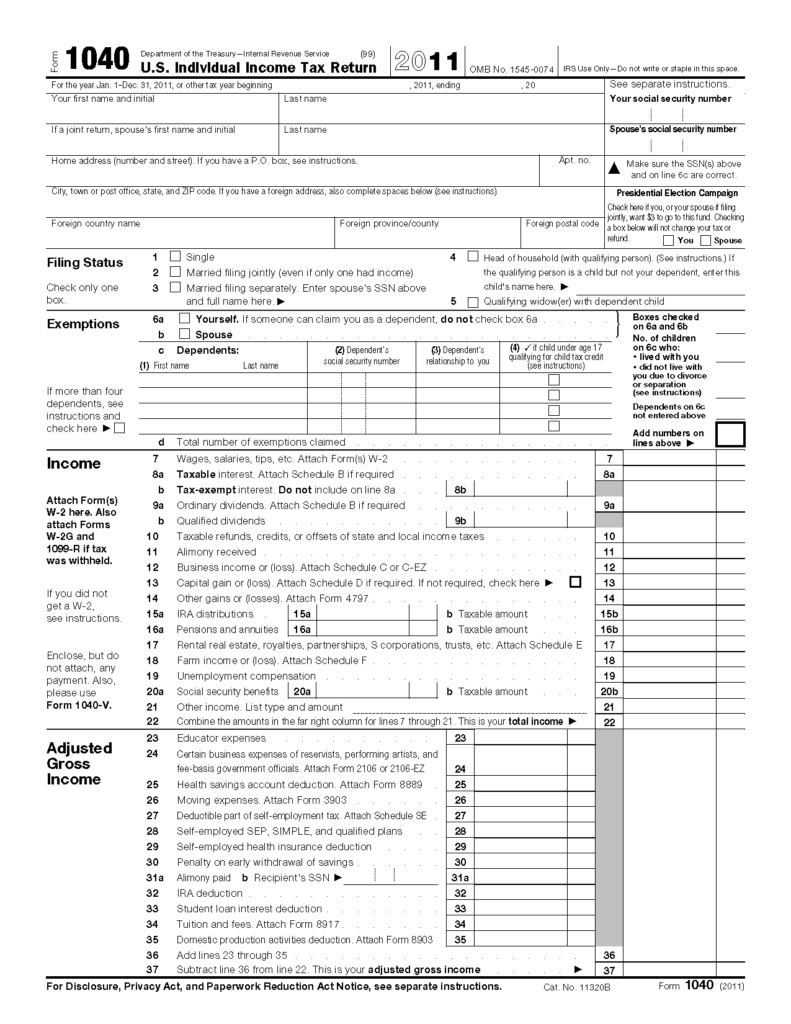

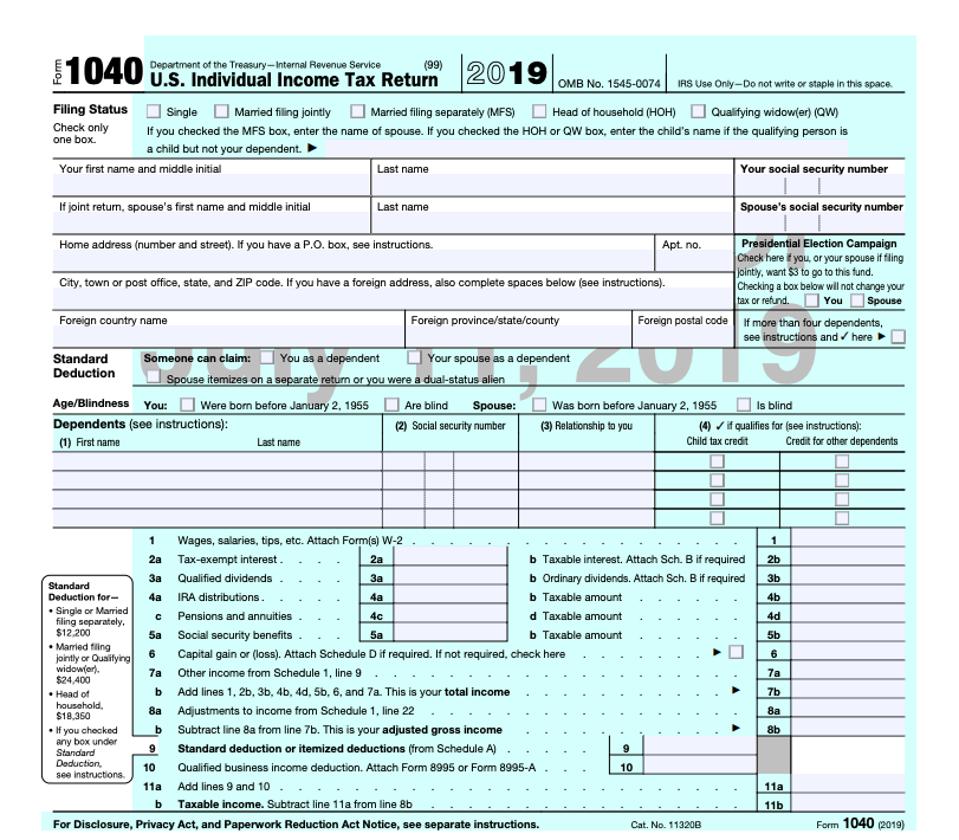

Form 1040 is the u.s. Irs use only—do not write or staple in this space. Web form 1040 (officially, the u.s. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Individual income tax return) is an irs tax form used for personal federal income tax returns filed by united states residents.

1040 U S Individual Tax Return Filing Status 2021 Tax Forms

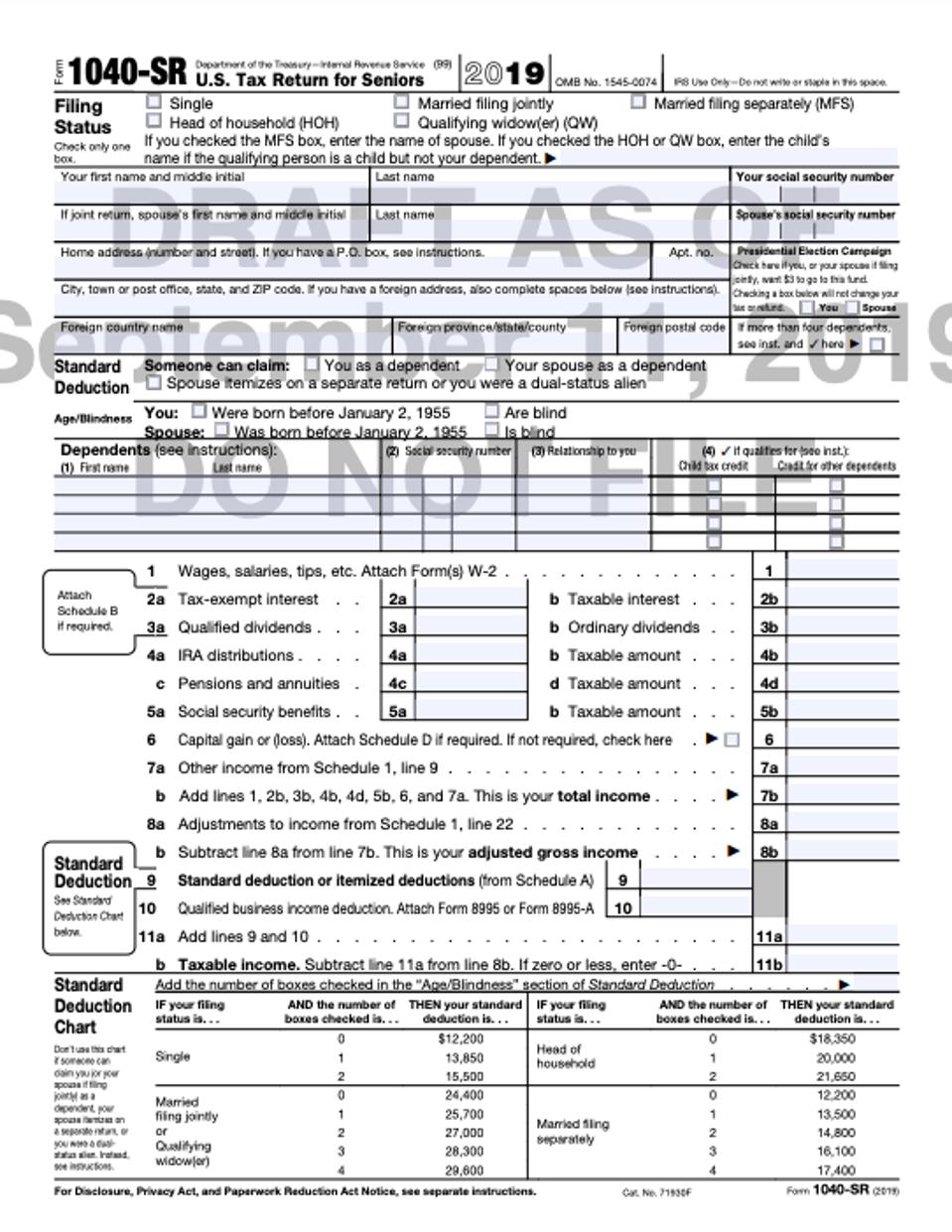

Web the irs has released a new tax filing form for people 65 and older. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Go to the input return tab. Individual tax return form 1040 instructions; It is the simplest form for individual federal income tax returns filed with the.

Form1040allpages PriorTax Blog 2021 Tax Forms 1040 Printable

Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. You only received a w2. Irs use only—do not write or staple in this space. With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry as a.

Form 1040 U S Individual Tax Return 2021 Tax Forms 1040 Printable

Web get federal tax return forms and file by mail. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Request for taxpayer identification number (tin) and certification form 4506. Get paper copies of federal and state tax forms, their instructions, and the address for.

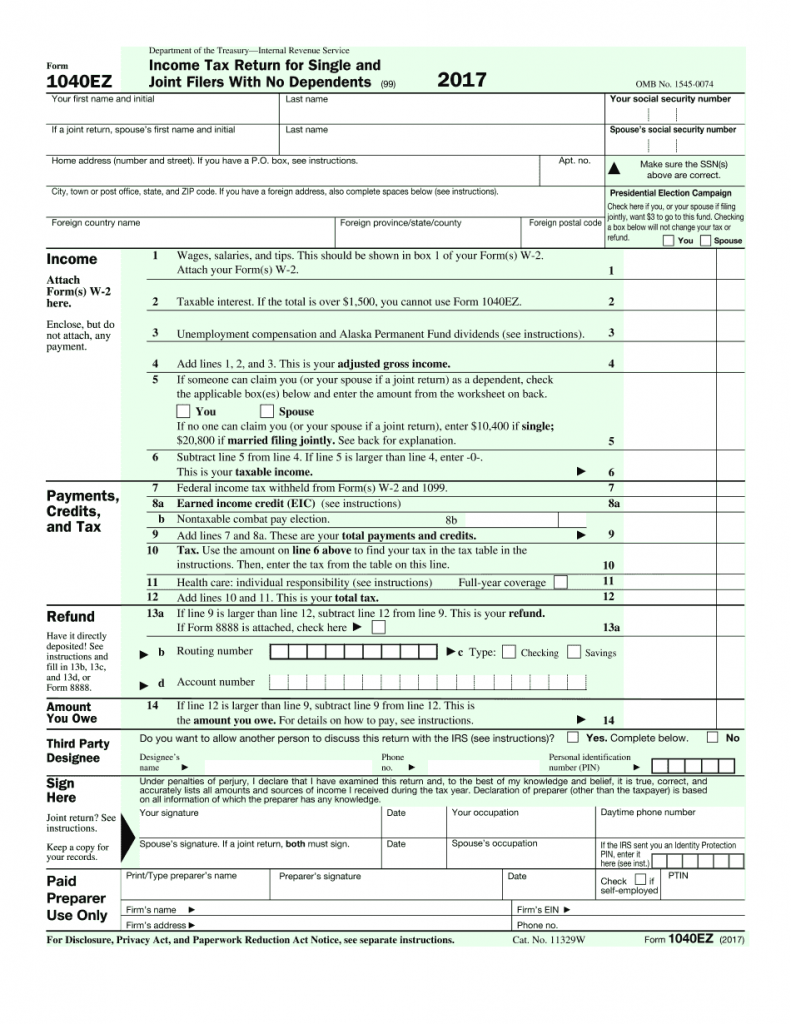

Printable 1040 Ez Forms Printable Form 2022

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. This readymade template is a smart pdf form, meaning it will automatically. Web to force the schedule a to print. Federal individual income tax return. Individual income tax return 2021 department of the treasury—internal revenue.

IRS 1040 Form Template Create and Fill Online Tax Forms

Go to the less common scenarios tab. File for free using the irs’ free file tool. Once completed you can sign your fillable form or send for signing. Request for taxpayer identification number (tin) and certification form 4506. Irs use only—do not write or staple in this space.

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

Individual tax return form 1040 instructions; Irs use only—do not write or staple in this space. Individual tax return form 1040 instructions; It is the simplest form for individual federal income tax returns filed with the irs. Web as of the 2018 tax year, form 1040, u.s.

How Do You Get A 1040 Tax Form Tax Walls

Web form 1040 (officially, the u.s. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Individual income tax return (irs) on average this form takes 27 minutes to complete. They are due each year on april 15 of the year after the tax year in question. Web version f, cycle 10.

Form 1040 U.S. Individual Tax Return Definition

To use the irs’ free file tool, residents must have less than. Individual tax return form 1040 instructions; Request for transcript of tax return Individual income tax return, including recent updates, related forms and instructions on how to file. Printable 2021 federal income tax forms 1040, 1040ss, 1040pr, 1040nr, 1040x, instructions, schedules, and more.

Irs use only—do not write or staple in this space. Individual income tax return 2020 department of the treasury—internal revenue service (99) omb no. Web use form 1040ez (quick & easy) if: Web the irs has released a new tax filing form for people 65 and older. Federal individual income tax return. Your taxable income is less than $100,000. Individual income tax return, including recent updates, related forms and instructions on how to file. Web popular forms & instructions; Once completed you can sign your fillable form or send for signing. Individual tax return form 1040 instructions; They are due each year on april 15 of the year after the tax year in question. Individual income tax return, is the only form used for personal (individual) federal income tax returns filed with the irs. It is the simplest form for individual federal income tax returns filed with the irs. Web information about form 1040, u.s. Web version f, cycle 10. Go to the input return tab. This readymade template is a smart pdf form, meaning it will automatically. Irs use only—do not write or staple in this space. Individual income tax return (irs) on average this form takes 27 minutes to complete. Department of the treasury—internal revenue service.

Federal Individual Income Tax Return.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Individual tax return form 1040 instructions; Form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. To force the return to itemize deductions.

Irs Use Only—Do Not Write Or Staple In This Space.

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web for the 2022 tax year, federal tax form 1040, us individual income tax return, must be postmarked by april 18, 2023. It has bigger print, less shading, and features like a standard deduction chart. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw)

Form 1040 Is Used By Citizens Or Residents Of The United States To File An Annual Income Tax Return.

With our fillable form 1040 individual income tax return form, you can easily record your tax information from any device and save your entry as a pdf. It is the simplest form for individual federal income tax returns filed with the irs. If your spouse died in 2022 and you didn't remarry in 2022, or if your spouse died in 2023 before filing a return for 2022, you can file a joint return. Go to the input return tab.

File For Free Using The Irs’ Free File Tool.

Department of the treasury—internal revenue service. Through approved tax filing software. Individual income tax return) is an irs tax form used for personal federal income tax returns filed by united states residents. Once completed you can sign your fillable form or send for signing.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)