13 Week Cash Flow Forecast Template - As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows) for every week. Why should you automate your cash flow forecasts? “rolling” means that as you finish one week, you add another week of forecasting to the end of your forecast, so you are always looking 13 weeks ahead. Introducing our week cash flow template, which can be useful to businesses and private individuals as it. Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by a few key areas: 13 week cash flow forecasting. Weekly forecasting periods are best for forecasting one to four months into the future. This facilitates the best financial planning and decision making. Web use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. Web a 13 week cash flow model should not have complex formulas.

13Week Cash Flow Model (TWCF) Template Example

Introducing our week cash flow template, which can be useful to businesses and private individuals as it. “rolling” means that as you finish one week, you add another week of forecasting to the end of your forecast, so you are always looking 13 weeks ahead. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors.

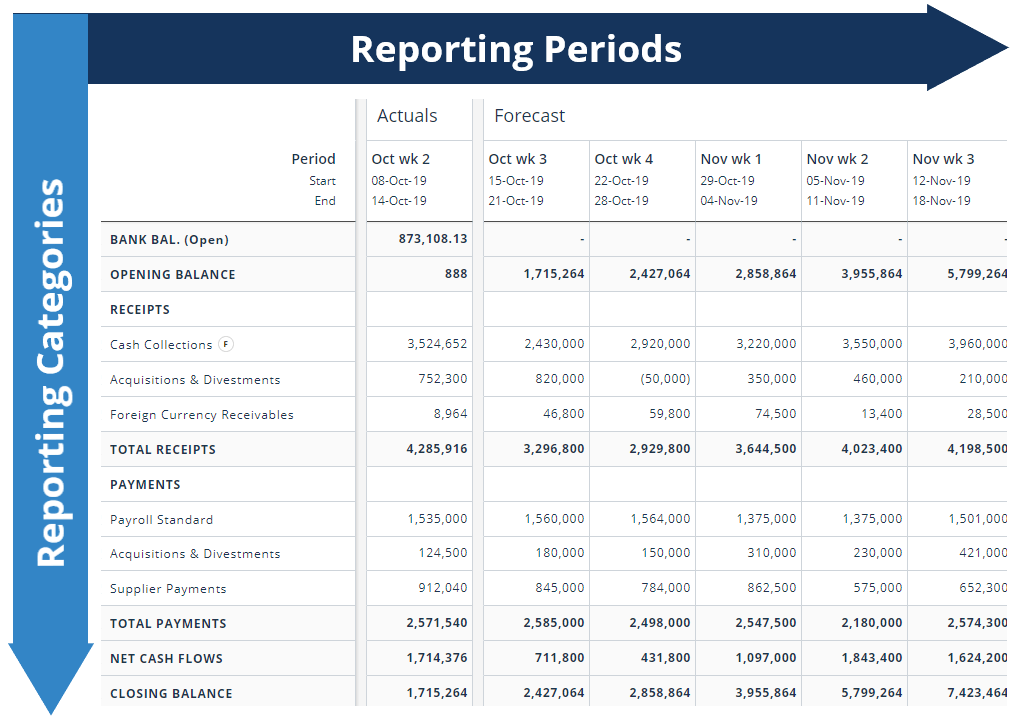

Rolling 13 Month Cash Flow Report Example, Uses

This facilitates the best financial planning and decision making. Web this simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. Perform short term planning and. Web the 13 week cashflow model is typically created using the direct.

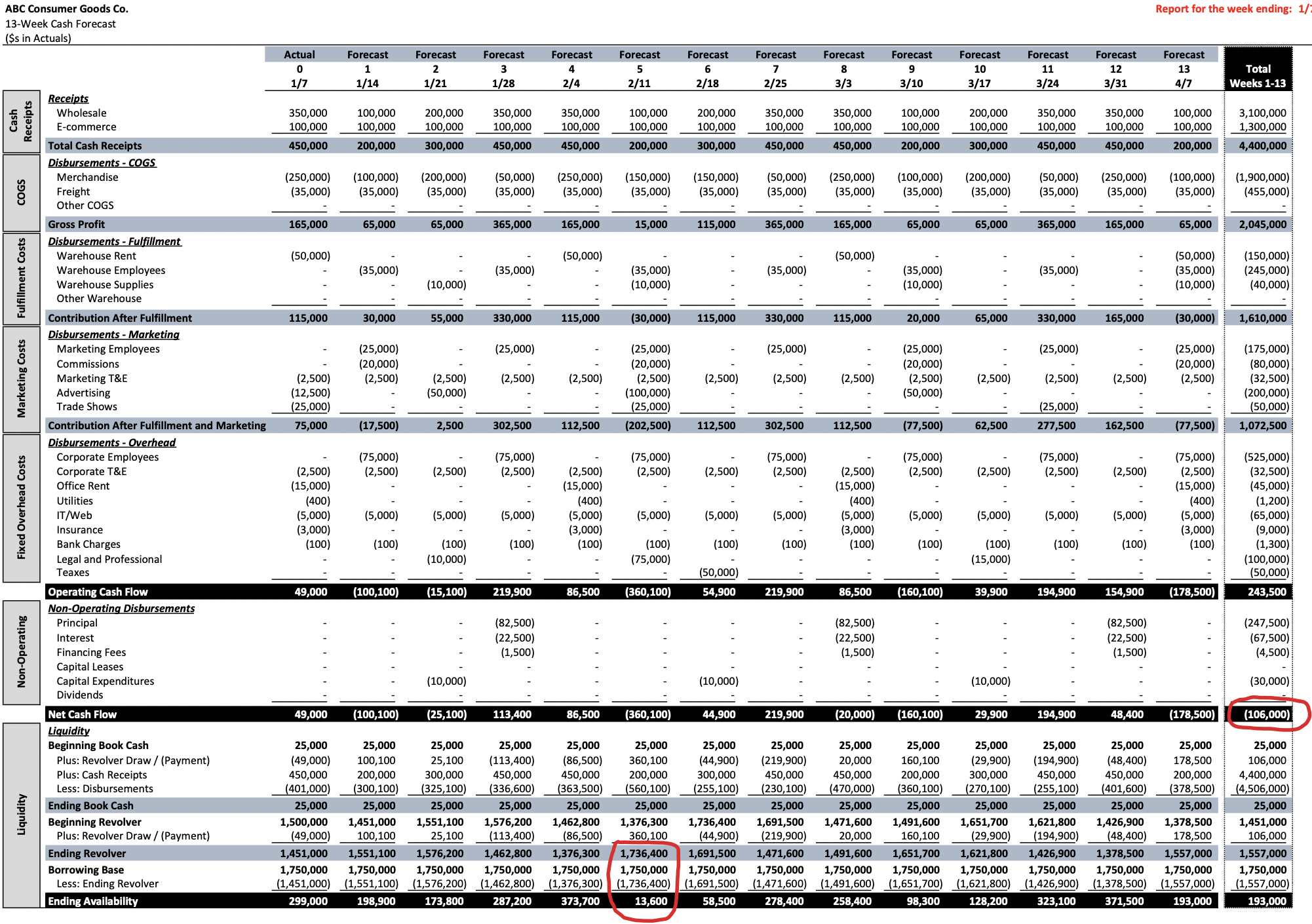

Demystifying the 13 Week Cash Flow Model in Excel Wall Street Prep

Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by a few key areas: At a moment’s notice, your designated marty mcfly could leap into the future, grab financial data by the fistful, and. Web a 13 week cash flow model should.

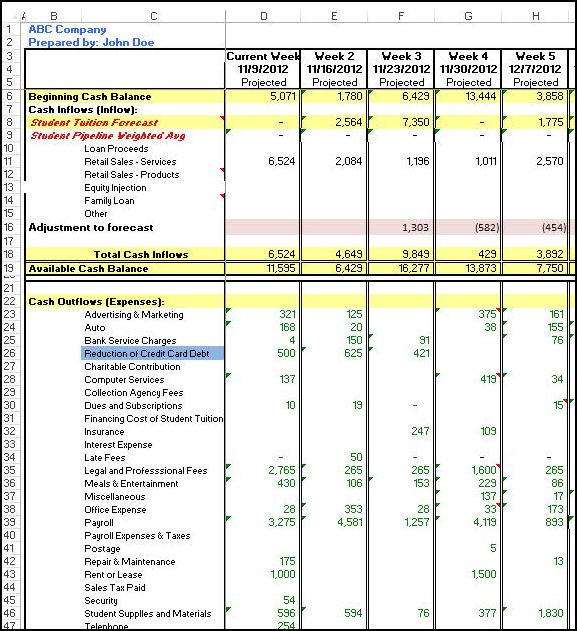

Cash Flow Projections Spreadsheet Natural Buff Dog

This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. Why should you automate your cash flow forecasts? Perform short term planning and. As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting.

Main screen image of 13 week cash flow forecast Business Finance

Web a 13 week cash flow model should not have complex formulas. Weekly forecasting periods are best for forecasting one to four months into the future. This facilitates the best financial planning and decision making. Web 13 weeks is the most popular cash forecasting time horizon. 13 week cash flow forecasting.

How to set up a best practice 13week cash flow forecast

Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by a few key areas: As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows).

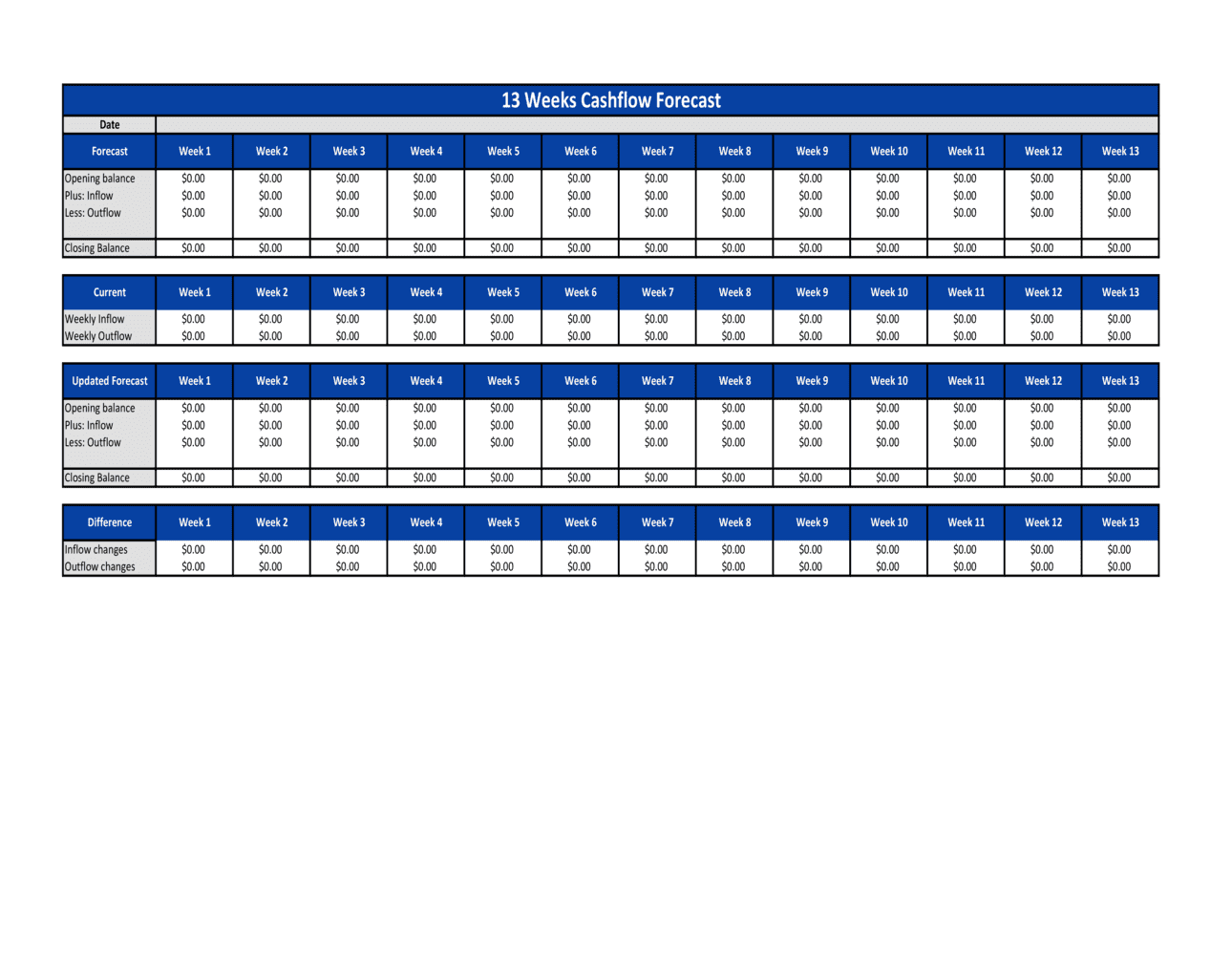

13 Weeks Cashflow Forecast Template by BusinessinaBox™

Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. This facilitates the best financial planning and decision making. This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. Automate manual forecasting tasks and the collection of.

13 Week Cash Flow YouTube

“rolling” means that as you finish one week, you add another week of forecasting to the end of your forecast, so you are always looking 13 weeks ahead. Why should you automate your cash flow forecasts? Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. This template is a powerful tool that.

13Week Cash Forecasting Overview — Cronkhite Capital

Automate manual forecasting tasks and the collection of all actual and forecast data to significantly reduce the effort involved in managing a 13 week cash flow forecast. Perform short term planning and. Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by.

Demystifying the 13 Week Cash Flow Model in Excel Wall Street Prep

This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows) for every week. Web 13 weeks is the most popular cash forecasting time horizon..

As the name suggests, this model helps you forecast weekly business cash flow over a period of 13 weeks by subtracting cash disbursements (outflows) from cash receipts (inflows) for every week. Web this simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Why should you automate your cash flow forecasts? Web a 13 week cash flow model should not have complex formulas. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. 13 week cash flow forecasting. Web use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. This facilitates the best financial planning and decision making. Web 13 weeks is the most popular cash forecasting time horizon. This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by a few key areas: “rolling” means that as you finish one week, you add another week of forecasting to the end of your forecast, so you are always looking 13 weeks ahead. Perform short term planning and. At a moment’s notice, your designated marty mcfly could leap into the future, grab financial data by the fistful, and. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. Automate manual forecasting tasks and the collection of all actual and forecast data to significantly reduce the effort involved in managing a 13 week cash flow forecast. Weekly forecasting periods are best for forecasting one to four months into the future. Introducing our week cash flow template, which can be useful to businesses and private individuals as it.

As The Name Suggests, This Model Helps You Forecast Weekly Business Cash Flow Over A Period Of 13 Weeks By Subtracting Cash Disbursements (Outflows) From Cash Receipts (Inflows) For Every Week.

This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. Weekly forecasting periods are best for forecasting one to four months into the future. This template is a powerful tool that allows you to project incoming and outgoing cash, helping you to visualize your financial situation over the next quarter. Web this simple cash flow forecast template provides a scannable view of your company’s projected cash flow.

13 Week Cash Flow Forecasting.

Web use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. Introducing our week cash flow template, which can be useful to businesses and private individuals as it. Web the 13 week cashflow model is typically created using the direct method of forecasting cash flows, using cash receipts (inflows) and cash disbursements (outflows) broken down by a few key areas:

At A Moment’s Notice, Your Designated Marty Mcfly Could Leap Into The Future, Grab Financial Data By The Fistful, And.

Why should you automate your cash flow forecasts? Automate manual forecasting tasks and the collection of all actual and forecast data to significantly reduce the effort involved in managing a 13 week cash flow forecast. Perform short term planning and. This facilitates the best financial planning and decision making.

“Rolling” Means That As You Finish One Week, You Add Another Week Of Forecasting To The End Of Your Forecast, So You Are Always Looking 13 Weeks Ahead.

Web a 13 week cash flow model should not have complex formulas. Web 13 weeks is the most popular cash forecasting time horizon.