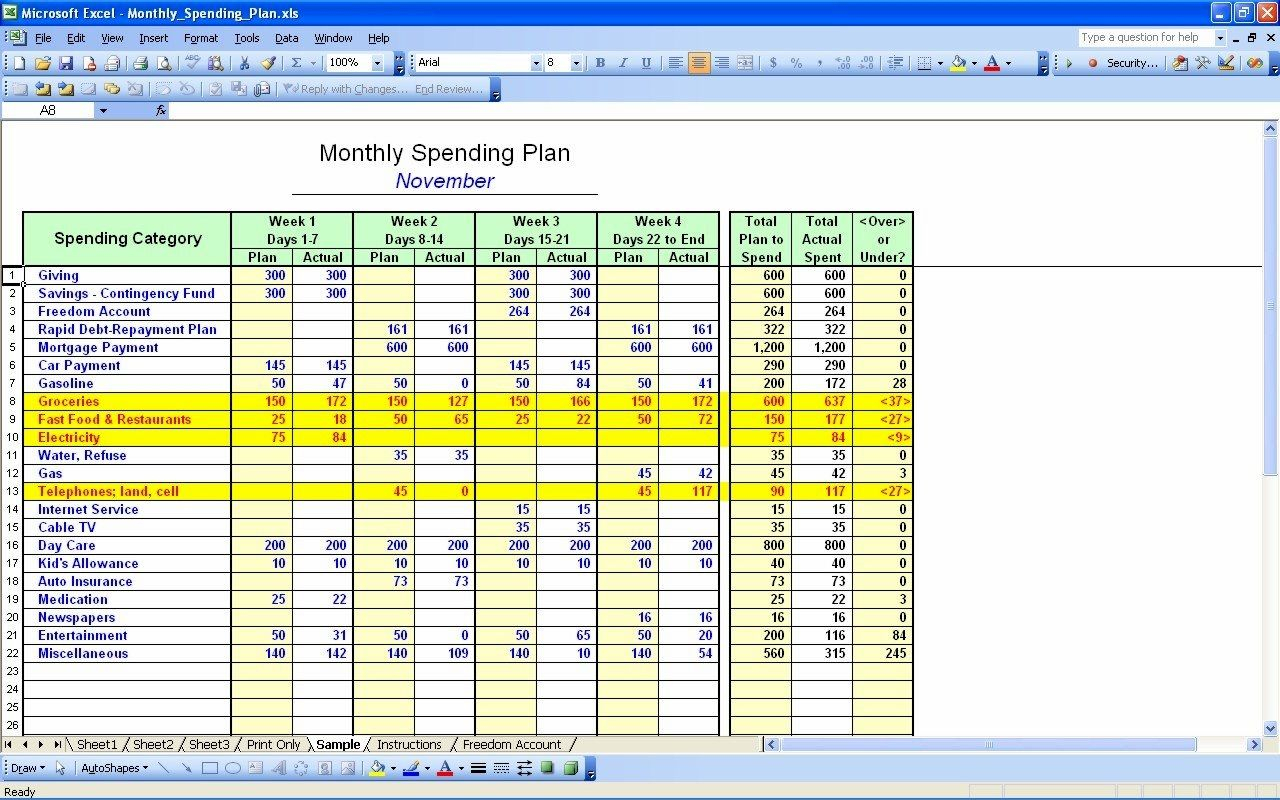

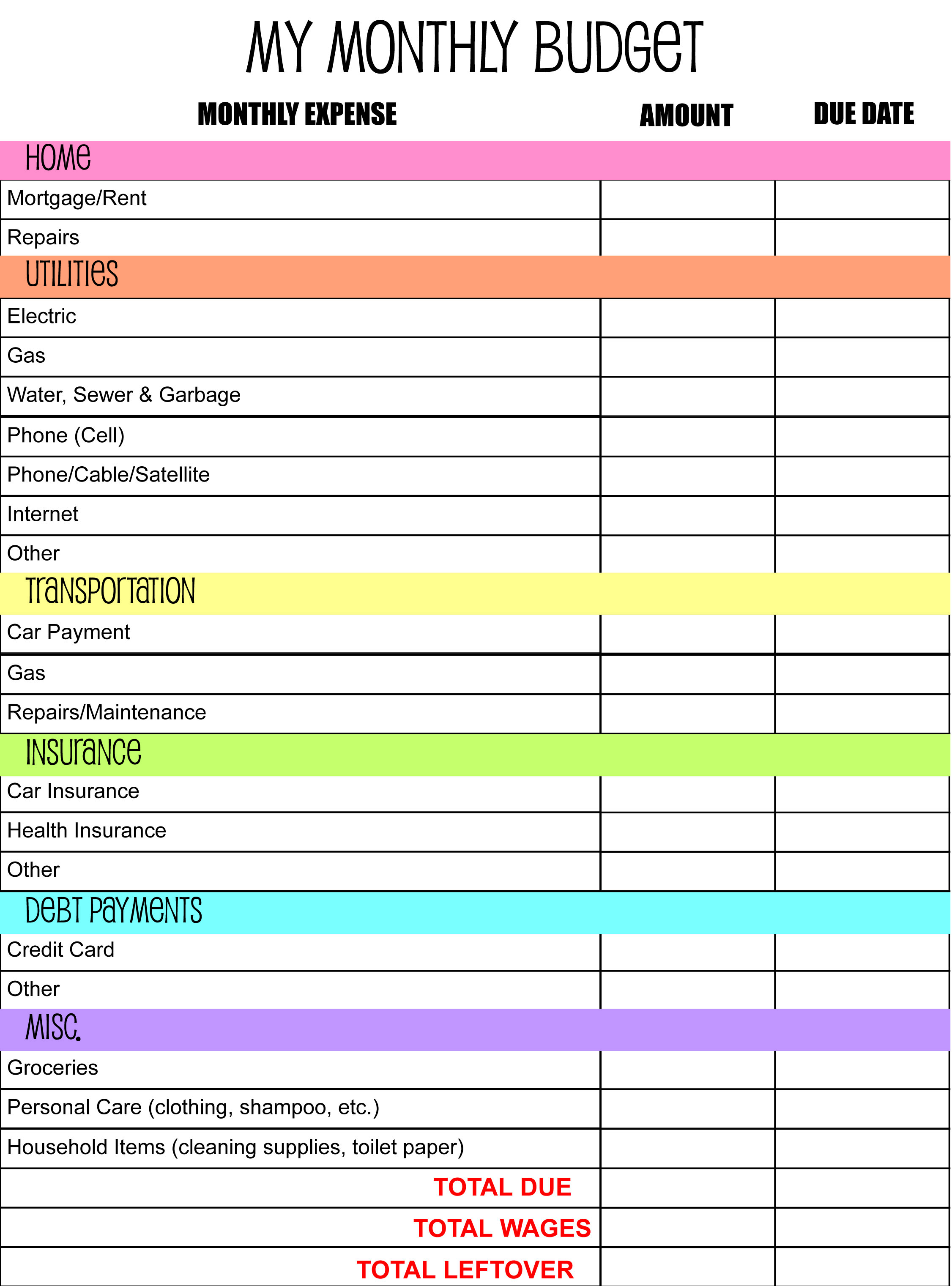

50/30/20 Budget Template Excel - How to set up a 50 / 30 / 20 budget. Figure out your total monthly income; 50% for needs, 30% for wants, and also 20% for savings. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Compute expenses in 3 different categories step 04: Who is this budget method for? Adjust your actual spending to fit; Determine surplus or shortage step 06: Insert chart to visualize easily free template:.

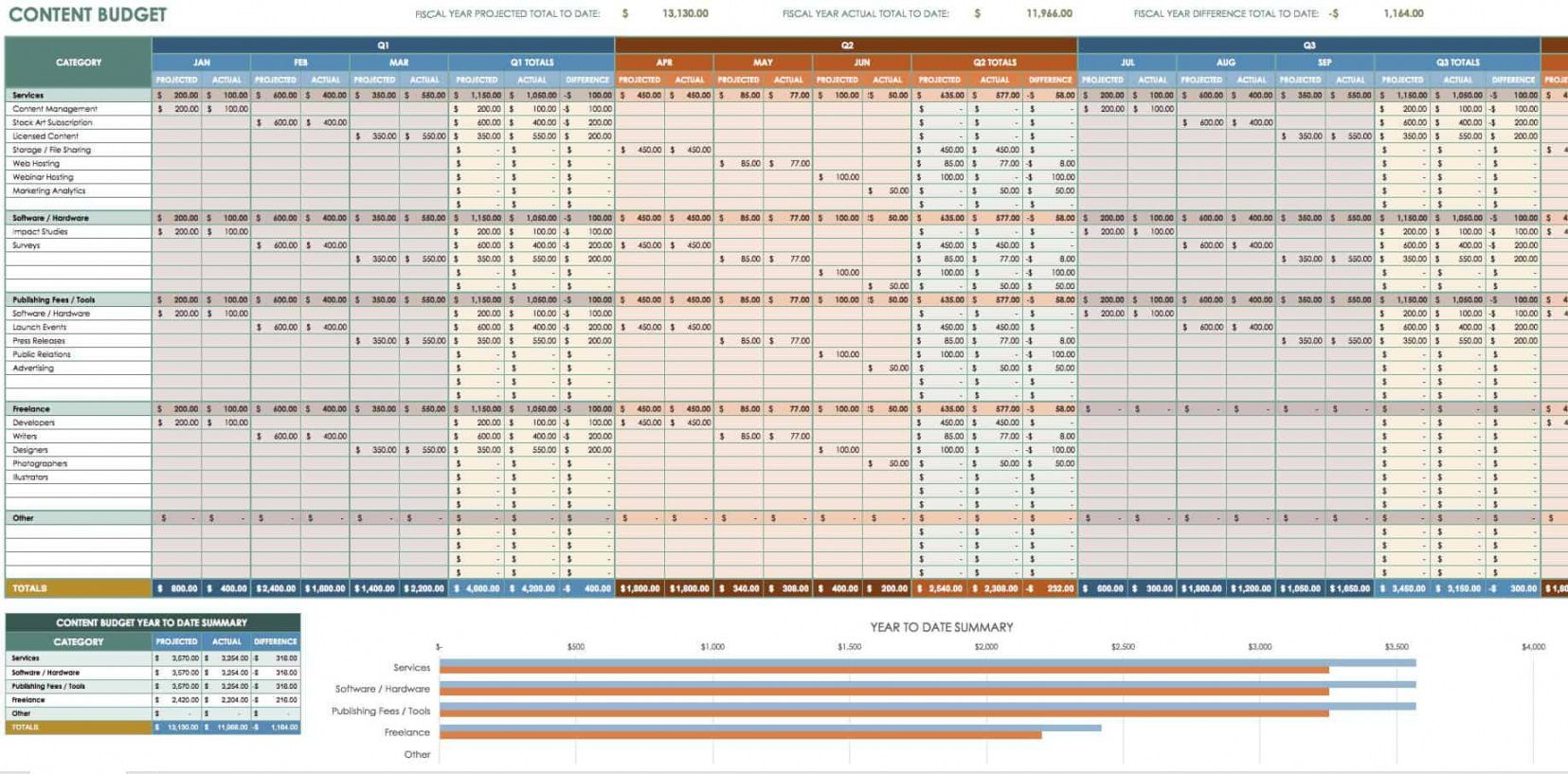

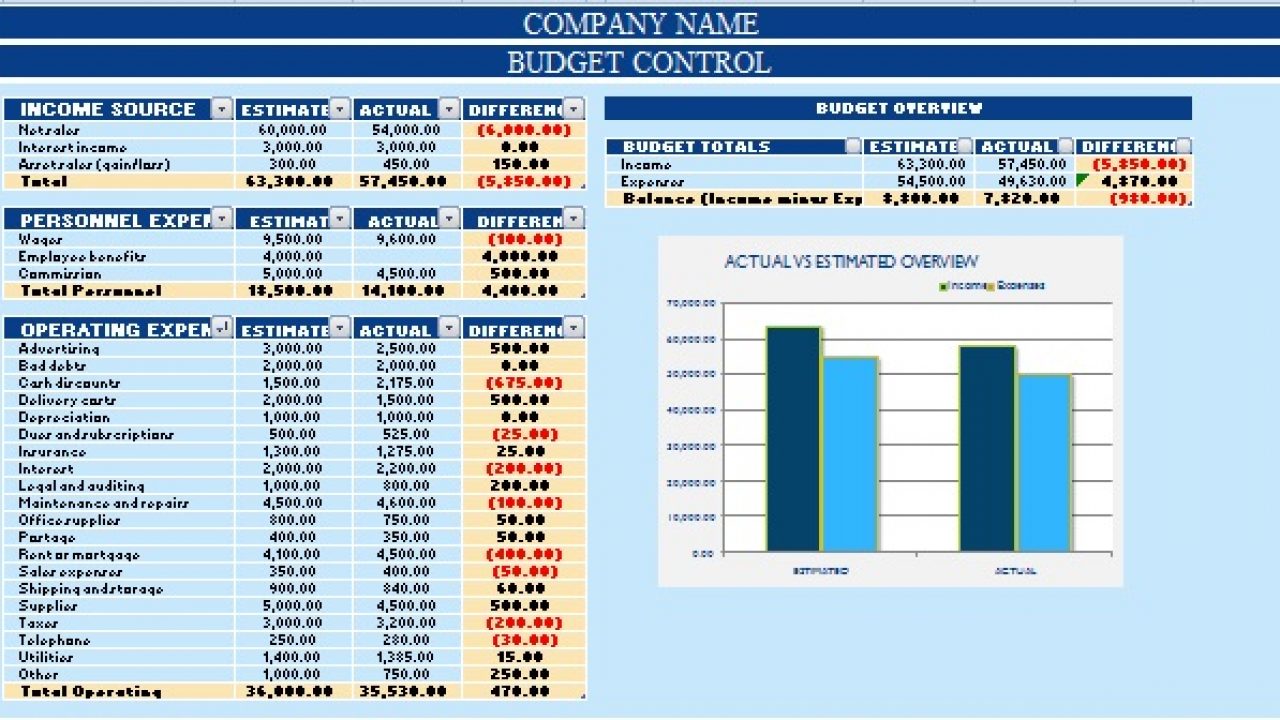

Marketing Communications Budget Template

Web it sounds harder than it is. Figure out your total monthly income; Web percentages for your budget. Insert chart to visualize easily free template:. Adjust your actual spending to fit;

503020 Budgeting LAOBING KAISUO

Web to start making your budget, you have to go to the source of it all: Adjust your actual spending to fit; How do you pay off debt with a 50 / 20 / 30 budget? Web percentages for your budget. 50% for needs, 30% for wants, and also 20% for savings.

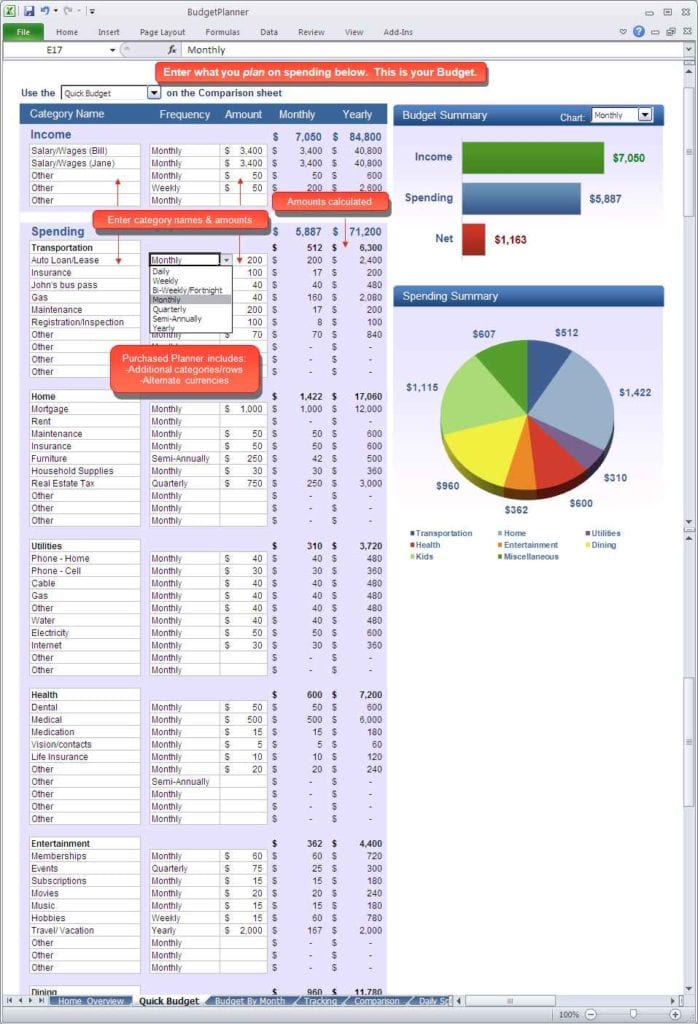

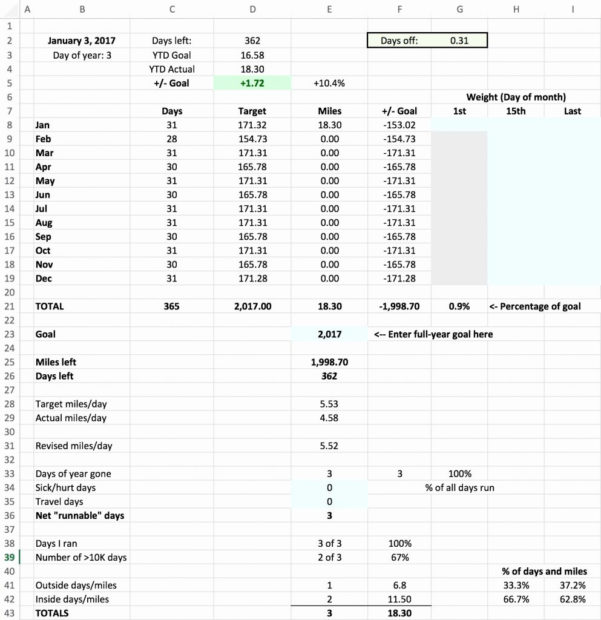

dave ramsey budget spreadsheet excel free —

Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. How do you pay off debt with a 50 / 20 / 30 budget? Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796..

50 30 20 Budget Excel Spreadsheet with regard to Template Budget

Insert chart to visualize easily free template:. If this budget sheet isn’t right for you, try another tool. Calculate monthly income step 02: Web it sounds harder than it is. Web what is the 50 30 20 rule?

50 30 20 Budget Excel Spreadsheet —

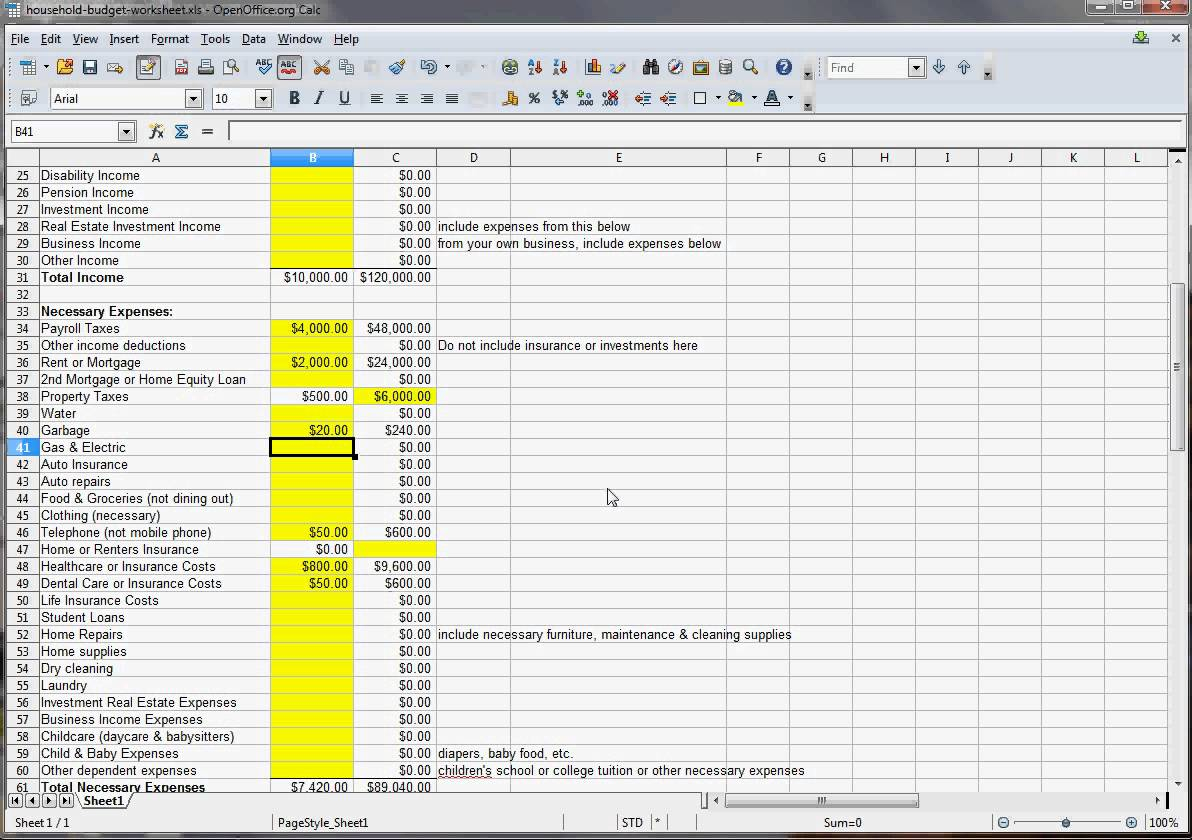

Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. Split your income between the 3 categories; If this budget sheet isn’t right for you, try another tool. Needs (50%),.

Free 50/30/20 Budget Calculator for Your Foundation Template

Follow along for a quick budget example. Compute expenses in 3 different categories step 04: Web percentages for your budget. How to set up a 50 / 30 / 20 budget. Needs (50%), wants (30%) and savings (20%).

50 30 20 Budget Spreadsheet Template throughout 50 30 20 Budget

Determine surplus or shortage step 06: Web percentages for your budget. Follow along for a quick budget example. And then make three columns: How to set up a 50 / 30 / 20 budget.

50 30 20 Budget Spreadsheet Template Google Spreadshee 50 30 20 budget

What budget apps work with the 50 / 30 /. $720 (401k and hsa) total income: Calculate monthly income step 02: The 50% needs category is for all your monthly essentials. Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide.

Student Budget Planner Spreadsheet —

Figure out your total monthly income; Web to start making your budget, you have to go to the source of it all: And then make three columns: Compute expenses in 3 different categories step 04: Insert chart to visualize easily free template:.

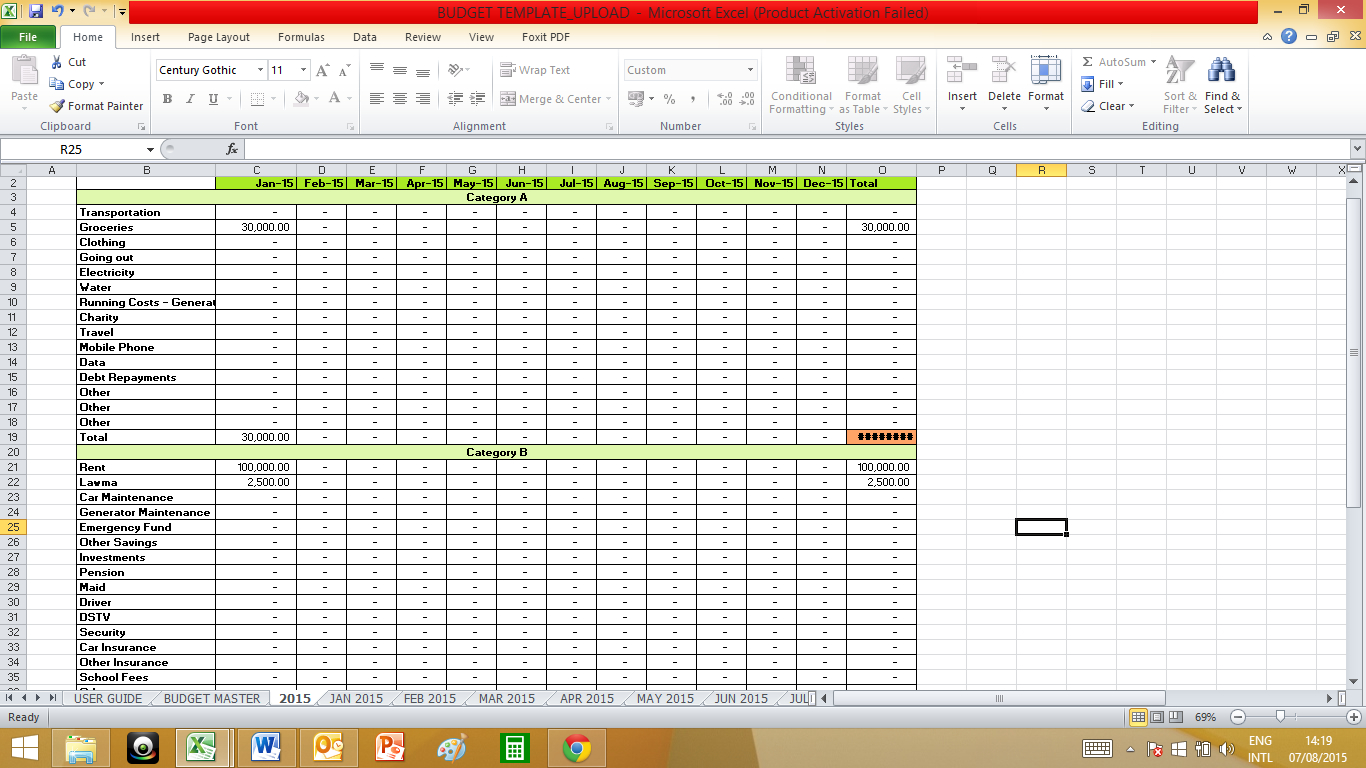

Budget Vs Actual Excel Template For Your Needs

Web it sounds harder than it is. Determine surplus or shortage step 06: Compute expenses in 3 different categories step 04: Insert chart to visualize easily free template:. Compare actual expenses with the ideal budget step 05:

Insert chart to visualize easily free template:. Figure out your total monthly income; Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). Web to start making your budget, you have to go to the source of it all: Adjust your actual spending to fit; The 50% needs category is for all your monthly essentials. Determine surplus or shortage step 06: Needs (50%), wants (30%) and savings (20%). Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Who is this budget method for? Compare actual expenses with the ideal budget step 05: Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. And then make three columns: Follow along for a quick budget example. 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. $720 (401k and hsa) total income: 50% for needs, 30% for wants, and also 20% for savings. Calculate monthly income step 02: How to set up a 50 / 30 / 20 budget. Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide.

Who Is This Budget Method For?

Web with that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes toward needs, 30% toward wants and 20% toward. Web use the free budget worksheet below to see how your spending compares with the 50/30/20 budget guide. Choose a standard month and start by writing down your net employment income as well as all other recurring income (family allowances, invalidity pension…). If this budget sheet isn’t right for you, try another tool.

What Budget Apps Work With The 50 / 30 /.

Calculate monthly income step 02: Web to start making your budget, you have to go to the source of it all: Web percentages for your budget. Insert chart to visualize easily free template:.

Determine Surplus Or Shortage Step 06:

Needs 50% or $1990, wants 30% or $1194, savings & debts 20% or $796. $720 (401k and hsa) total income: How to set up a 50 / 30 / 20 budget. Figure out your total monthly income;

Needs (50%), Wants (30%) And Savings (20%).

And then make three columns: Web it sounds harder than it is. Web what is the 50 30 20 rule? 50% for needs, 30% for wants, and also 20% for savings.