Asc 842 Lease Accounting Excel Template - Web with a finance lease under asc 842, the calculation methodology to calculate the amortization rate post modification follows the same methodology at initial recognition. Click the link to download a template for asc 842. Operating lease treatment under asc 842 vs. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check into compliance with this standard. Web try leaseguru for free — our lease accounting software for small lease portfolios. A lease liability is the total financial obligation owed by the lessee toward the lessor. Ad asc 842 brought significant changes to lease accounting standards. Asc 842 lease classification test use this free tool to determine if your leases are classified as finance or operating leases under asc 842. Ad track everything in one place. Lease classification template a streamlined & simplified lease classification process for lessees lease classification test

Excel Solution

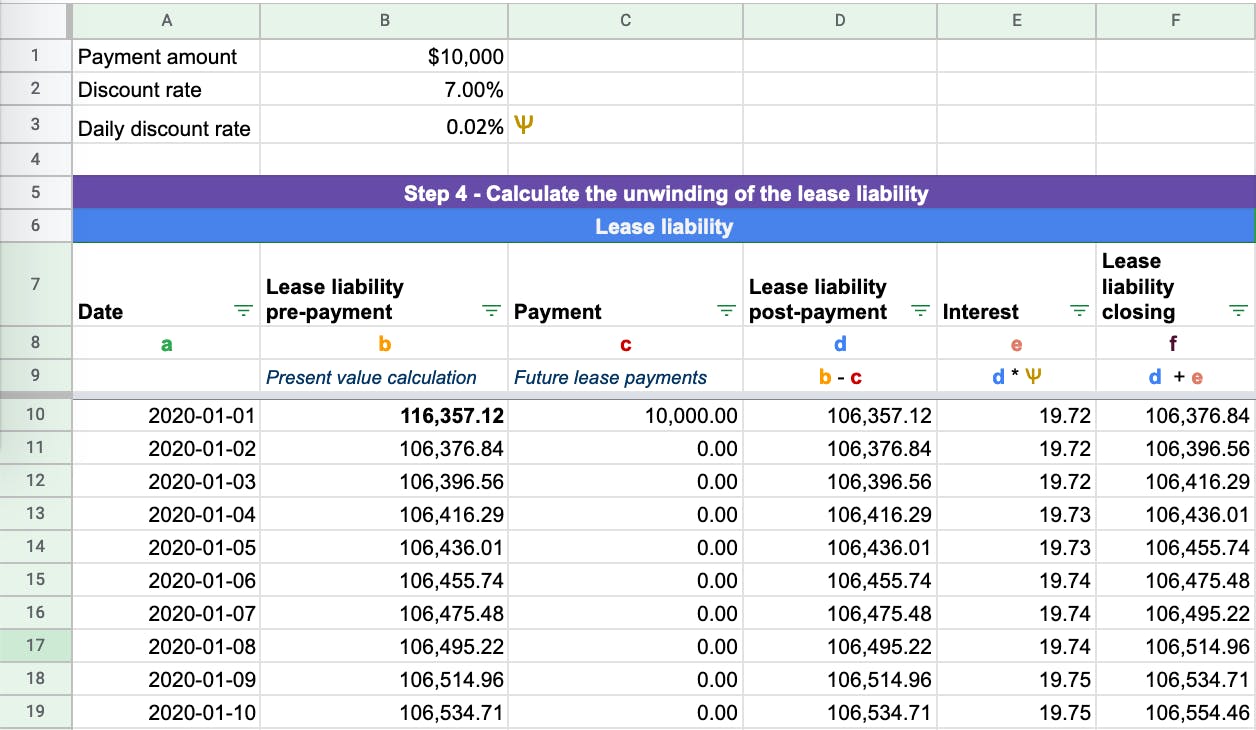

Ad track everything in one place. Web what is asc 842? Manage all your business expenses in one place with quickbooks®. Under asc 842, for leases with terms of 12 months or less, lessees can elect to not recognize. The lease liability we’re going to calculate is based on the following terms:

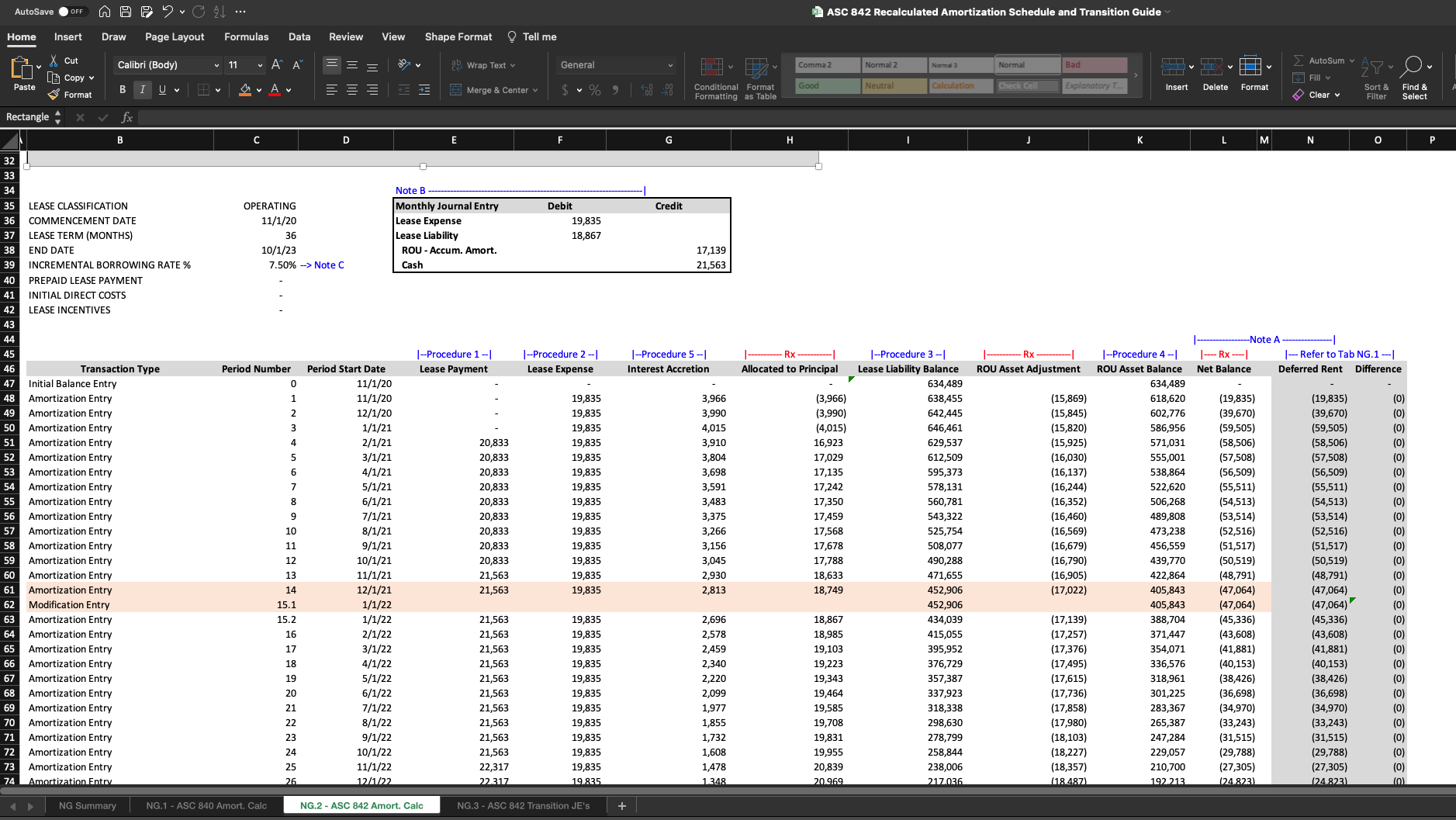

Lease Modification Accounting for ASC 842 Operating to Operating

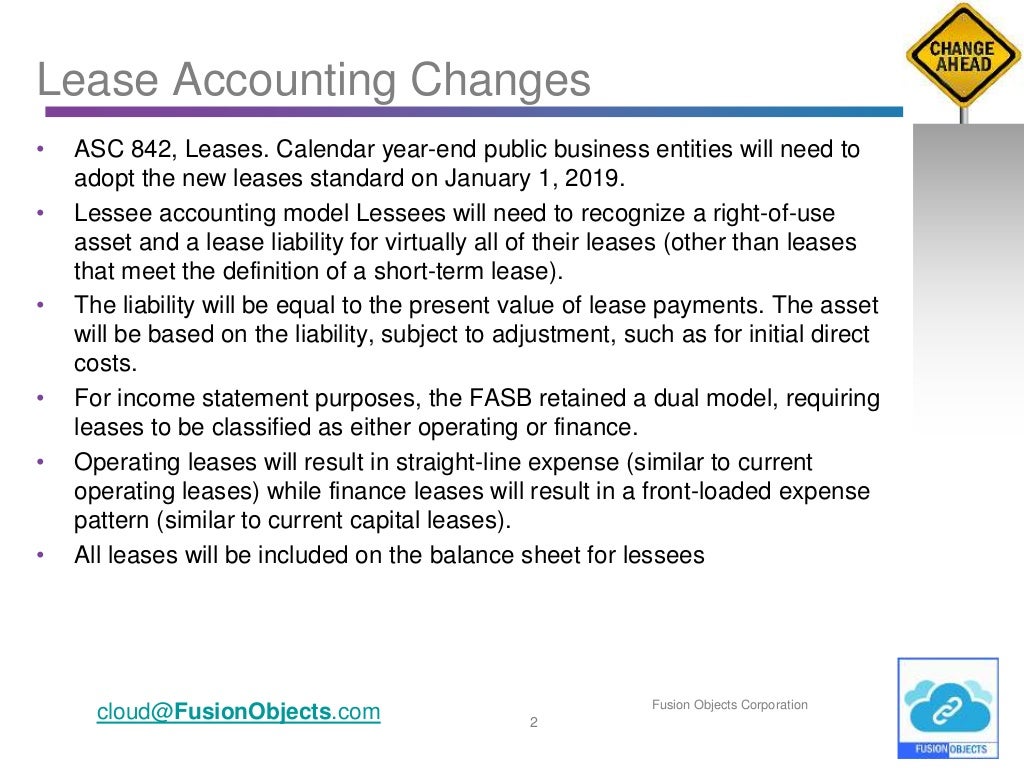

Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. Lease classification template a streamlined & simplified lease classification process for lessees lease classification test Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases..

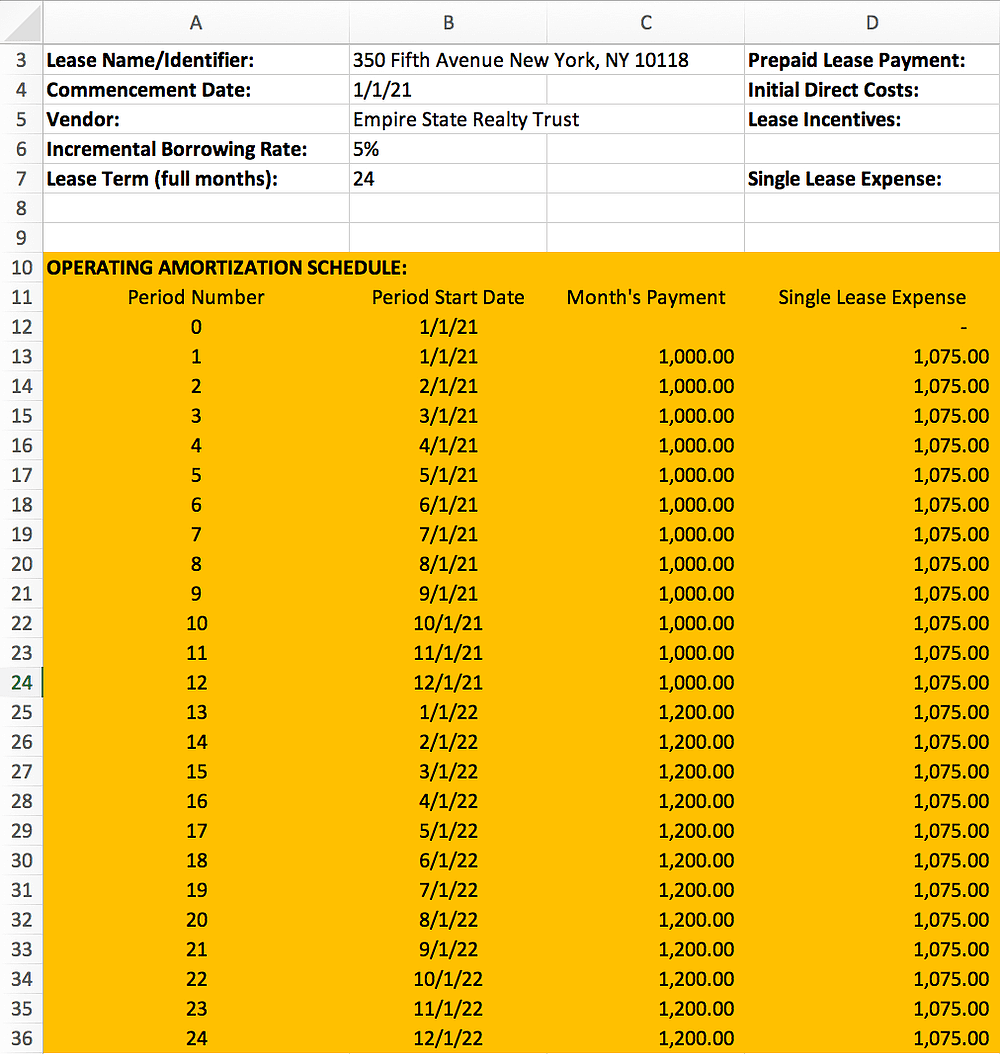

ASC 842 Excel Template Download

Value of the right of use asset divided by total remaining useful life days. Ad track everything in one place. Manage all your business expenses in one place with quickbooks®. The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. Web accounting standards update (asu) no.

A Quick Guide For Smooth Transition to New Lease Accounting Standard

Web accounting standards update (asu) no. As the name indicates, this standard has been in existence since 2016. Click the link to download a template for asc 842. Web try leaseguru for free — our lease accounting software for small lease portfolios. Ad asc 842 brought significant changes to lease accounting standards.

Asc 842 Operating Lease Excel Template templates.iesanfelipe.edu.pe

Web with a finance lease under asc 842, the calculation methodology to calculate the amortization rate post modification follows the same methodology at initial recognition. Among other changes, it requires all public and private entities reporting under us gaap to record the vast majority of their leases to the balance sheet. Adopting asc 842 a proactive approach to adoption can.

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Value of the right of use asset divided by total remaining useful life days. 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment. Web what is asc 842? Web download our free asc 842 lease accounting calculator and calculate the accounting impact.

Asc 842, leases overhaul of fas13 lease accounting

Ad track everything in one place. Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases. Adopting asc 842 a proactive approach to adoption can be beneficial. A lease liability is the total financial obligation owed by the lessee toward the lessor. Web try leaseguru for free — our lease accounting software.

Slide 1

They will significantly affect organizations having. Explore the #1 accounting software for small businesses. Web try leaseguru for free — our lease accounting software for small lease portfolios. A lease liability is the total financial obligation owed by the lessee toward the lessor. The lease liability we’re going to calculate is based on the following terms:

Favorite Asc 842 Excel Template Google Spreadsheet Personal Commission

Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment. It specifically does not apply to.

ASC 842 Lease Accounting Finance lease, Budget planning, Public company

Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases. Ad track everything in one place. Web larson lease accounting template asc 842. A lease liability is the total financial obligation owed by the lessee toward the lessor. As the name indicates, this standard has been in existence since 2016.

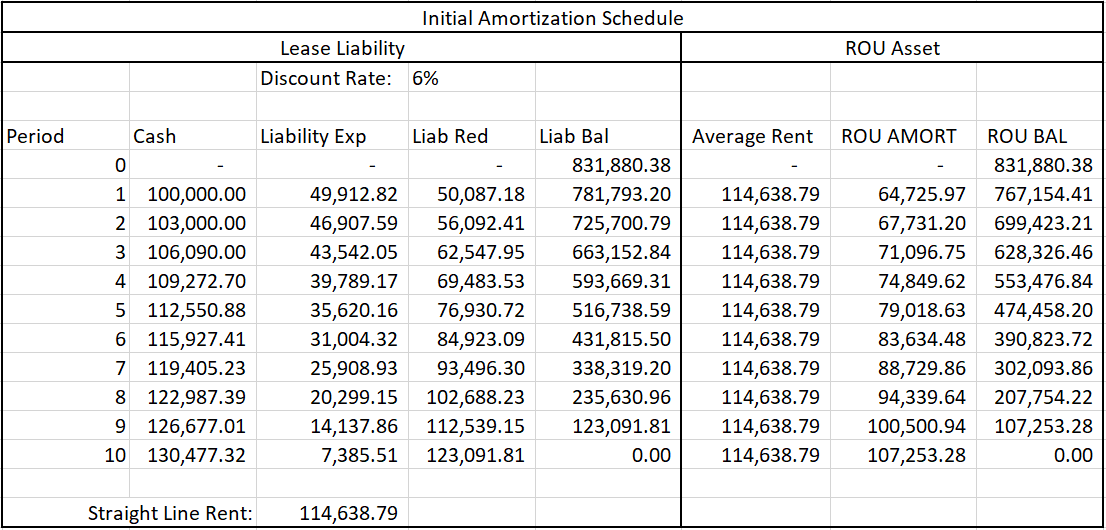

Asc 842 lease classification template Web larson lease accounting template asc 842. Explore the #1 accounting software for small businesses. The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be. Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. It specifically does not apply to the following nondepreciable assets accounted for under other fasb. Web accounting standards update (asu) no. As a result the calculation will be $28,546.45 / 77 = $370.73. Under asc 842, for leases with terms of 12 months or less, lessees can elect to not recognize. Web what is asc 842? Lease classification template a streamlined & simplified lease classification process for lessees lease classification test Finance lease identification under asc 842 transference of title/ownership to the lessee purchase option lease term for major part of the remaining economic life of the asset present value represents “substantially all” of the fair value of. Download the free asc 842 lease classification template to ensure you are in the know! Download the free asc 842 lease classification template to ensure you are in the know! Value of the right of use asset divided by total remaining useful life days. Web this downloadable resource addresses high level lease standard questions that may come up as firms and organizations check into compliance with this standard. $10,000 payments at the beginning of each year; 87 (gasb 87), change the financial reporting requirements of organizations that enter into leasing transactions or other contracts for assets such as real estate, vehicles and equipment. As the name indicates, this standard has been in existence since 2016. Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases.

Web Larson Lease Accounting Template Asc 842.

Ad track everything in one place. $10,000 payments at the beginning of each year; Refer below for seven steps on how to calculate the lease liability using excel’s goal seek. Asc 842 lease classification test use this free tool to determine if your leases are classified as finance or operating leases under asc 842.

They Will Significantly Affect Organizations Having.

Download the free asc 842 lease classification template to ensure you are in the know! Under asc 842, for leases with terms of 12 months or less, lessees can elect to not recognize. Asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of their lease agreements. The more extensive the entity’s leasing activities, the more comprehensive the disclosures are expected to be.

Web A Lease Liability Is Required To Be Calculated For Both Asc 842 & Ifrs 16.

Web asc 842 includes enhanced disclosure requirements, including an overall disclosure objective and expanded disclosure requirements for leases. Operating lease treatment under asc 842 vs. Value of the right of use asset divided by total remaining useful life days. The lease liability we’re going to calculate is based on the following terms:

Asc 842 Lease Classification Template

Ad asc 842 brought significant changes to lease accounting standards. As the name indicates, this standard has been in existence since 2016. Finance lease identification under asc 842 transference of title/ownership to the lessee purchase option lease term for major part of the remaining economic life of the asset present value represents “substantially all” of the fair value of. Click the link to download a template for asc 842.