Printable Amortization Schedule With Fixed Monthly Payment - Web use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. You can use this online amortization schedule calculator to calculate monthly payments for any type of loan, such as student loans, personal loans. The amortization table shows how each payment is applied to the principal balance and the interest owed. A portion of each payment is for interest while the remaining amount is. Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. To help make this easier, we’ve created a fully customizable template that you can export into a completed excel spreadsheet with just a few clicks. Amortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest. Web organizing is hard, so make a list of each payment on your mortgage over time with template.net’s free sample amortization schedule template. Monthly principal & interest $1,163 Create 30 year mortgage due plans or a 15 year monthly interest plan, or customize your own plan with our templates to guide you.

Loan Amortization Schedule Excel 30+ Free Example RedlineSP

Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Web use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. The amortization table shows how each payment is applied to the principal balance and the interest owed. Create.

Loan Amortization Schedule Excel 30+ Free Example RedlineSP

Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Payment amount = principal amount + interest amount This is a schedule showing the repayment period of the loan you have taken. Download balloon loan amortization schedule template excel | smartsheet Web loan calculator with printable amortization table.

Excel Loan Amortization Schedule Template For Your Needs

User can set loan date and first payment date independently. For a printable amortization schedule, click on the provided button and a new browser window will open. Payment amount = principal amount + interest amount Create printable amortization schedules with due dates; The free printable amortization schedule with fixed monthly payment is printable, downloadable as a pdf file, and exportable.

24 Free Loan Amortization Schedule Templates (MS Excel)

Calculate loan payment amount or other unknowns; Supports 9 types of amortization. To help make this easier, we’ve created a fully customizable template that you can export into a completed excel spreadsheet with just a few clicks. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how frequently.

Excel Loan Amortization Schedule Fixed Rate with Monthly Etsy

Monthly principal & interest $1,163 Web amortization schedule is an amortization calculator used to calculate mortgage or loan payments and generates a free printable amortization schedule with fixed monthly payment and amortization chart. Download balloon loan amortization schedule template excel | smartsheet Web this loan amortization template will calculate both your monthly payments and the balloon payment amount and schedule..

Amortization schedule with fixed monthly payment and balloon

Web this loan amortization template will calculate both your monthly payments and the balloon payment amount and schedule. Web loan calculator with printable amortization table. It is basically a table that determines the principal amount and amount of interest compromising each payment. Once you enter the loan term, amount borrowed & interest rate you can then create a. Web click.

Economic collapse preparation Amortization schedule with fixed monthly

A portion of each payment is for interest while the remaining amount is. Create 30 year mortgage due plans or a 15 year monthly interest plan, or customize your own plan with our templates to guide you. Web loan calculator with printable amortization table. Payment amount = principal amount + interest amount Web click on calculate and you’ll see a.

24 Free Loan Amortization Schedule Templates (MS Excel)

Web your amortization schedule will show you how much of your monthly mortgage payments you spend toward principal and interest. Calculate loan payment amount or other unknowns; Create printable amortization schedules with due dates; Web what is an amortization schedule? Whatever payment option you choose, amortization ensures that your interest and principal balance is reduced to zero once your loan.

8 Printable Amortization Schedule Templates SampleTemplatess

Web what exactly is an amortization schedule? You need to enter the required values, and the calculations will be. For a printable amortization schedule, click on the provided button and a new browser window will open. User can set loan date and first payment date independently. Web loan payment calculator with amortization schedule.

Amortization Schedule Excel Template Addictionary

Once you enter the loan term, amount borrowed & interest rate you can then create a. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how frequently the payments must be made. Each calculation done by the calculator will also come with an annual and monthly amortization schedule.

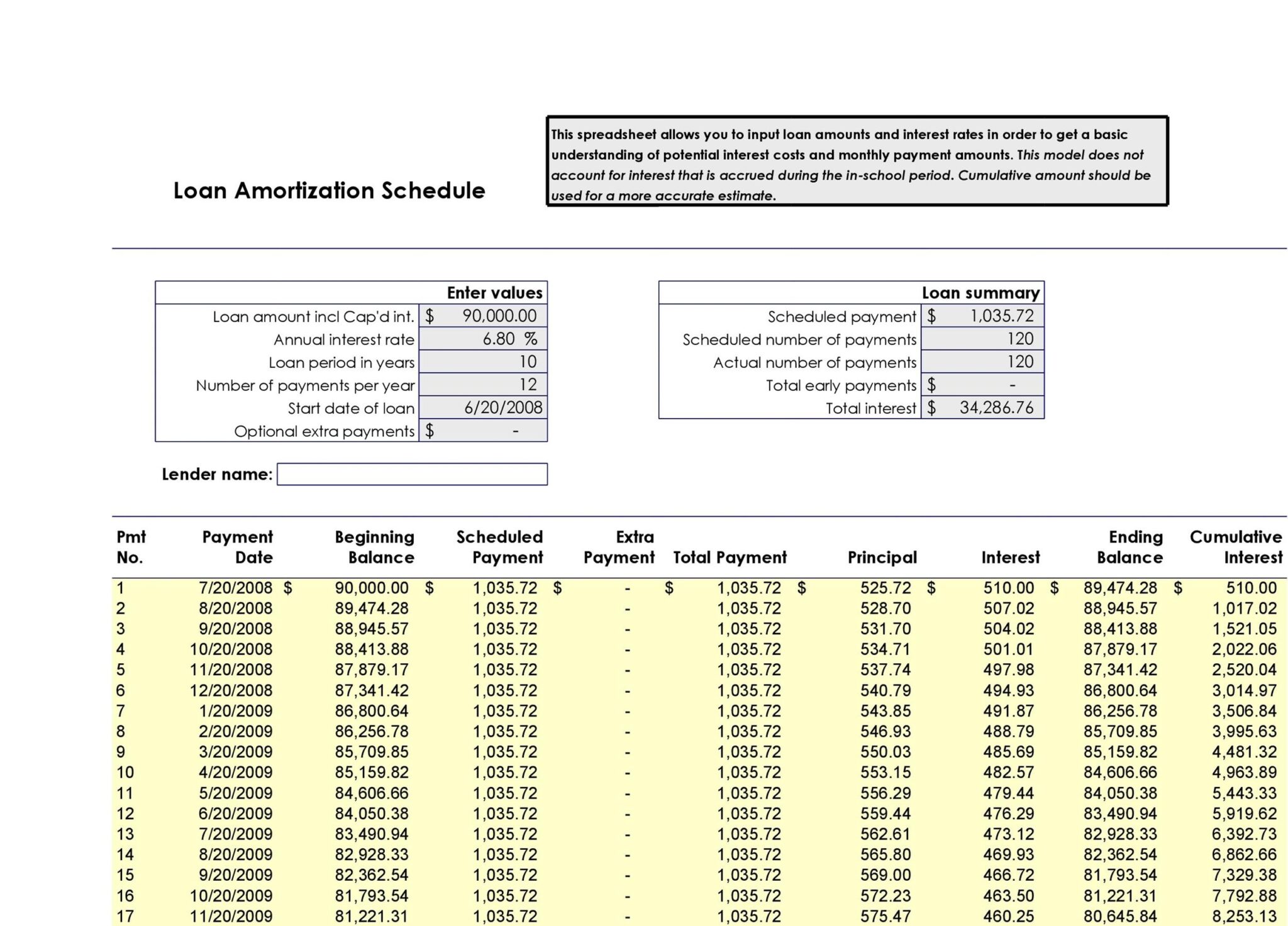

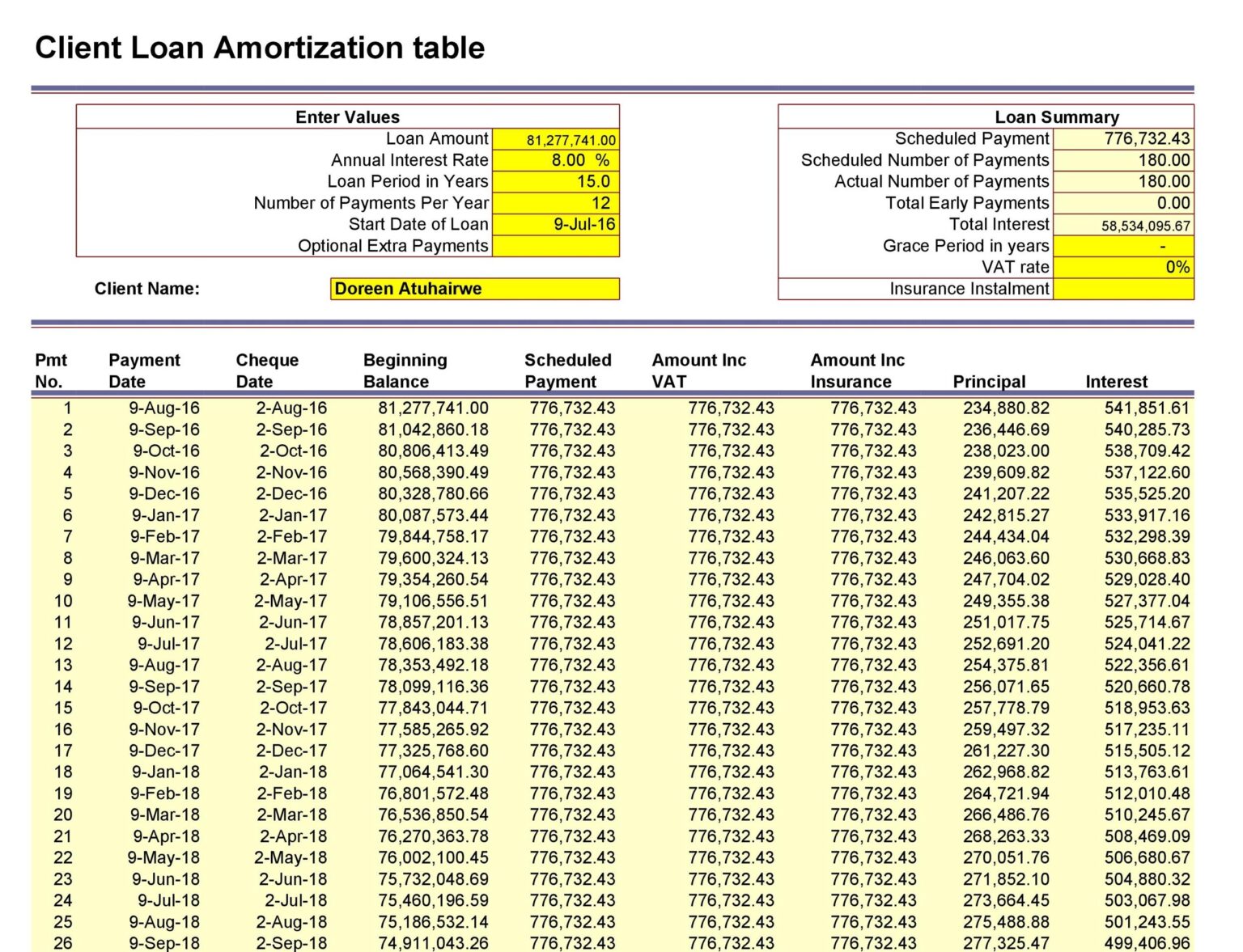

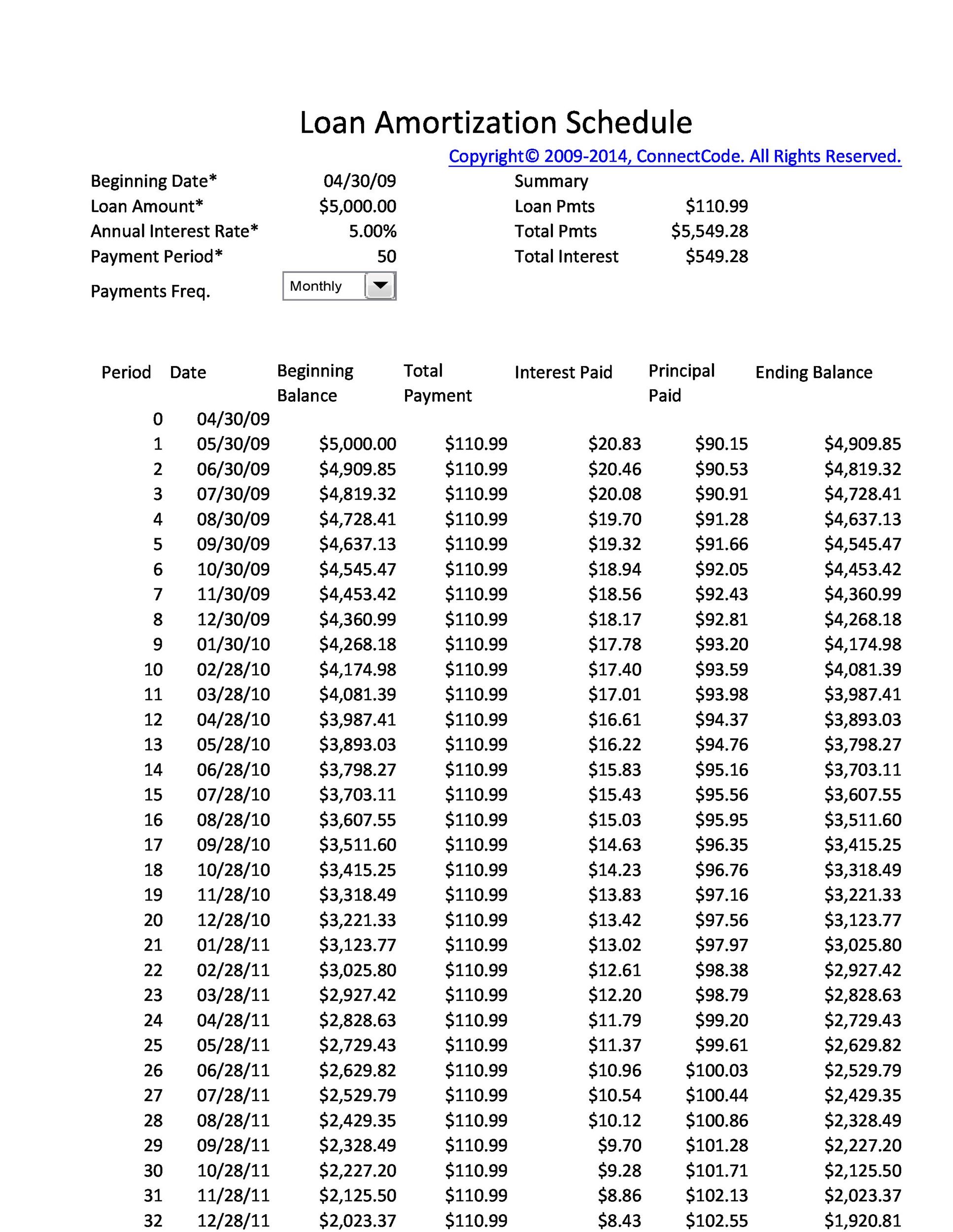

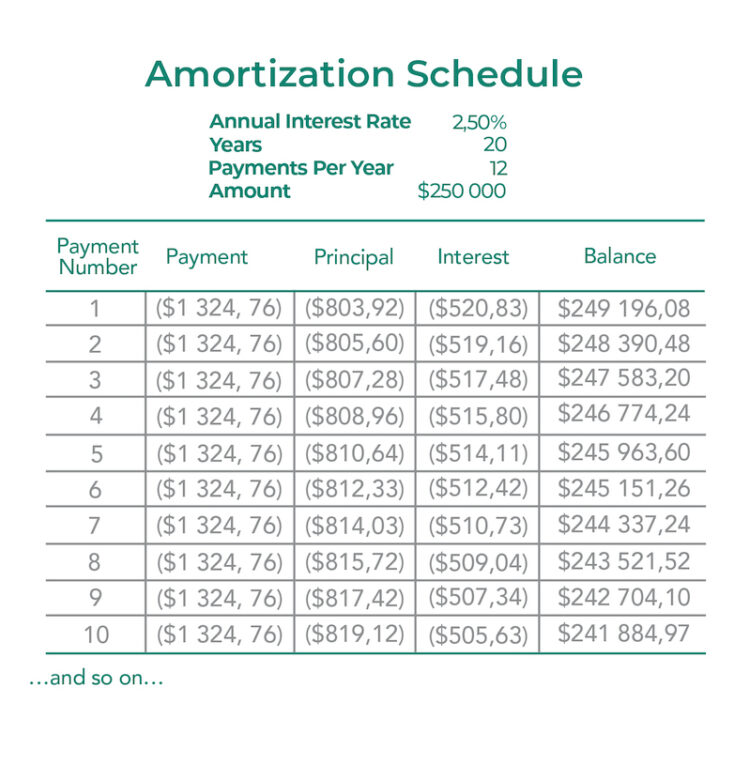

The amortization table shows how each payment is applied to the principal balance and the interest owed. Download balloon loan amortization schedule template excel | smartsheet User can set loan date and first payment date independently. Payment amount = principal amount + interest amount This is a schedule showing the repayment period of the loan you have taken. Start by entering the total loan amount, the annual interest rate, the number of years required to repay the loan, and how frequently the payments must be made. Create 30 year mortgage due plans or a 15 year monthly interest plan, or customize your own plan with our templates to guide you. You need to enter the required values, and the calculations will be. Web this loan amortization template will calculate both your monthly payments and the balloon payment amount and schedule. The free printable amortization schedule with fixed monthly payment is printable, downloadable as a pdf file, and exportable as an excel spreadsheet. Web what is an amortization schedule? Web click on calculate and you’ll see a dollar amount for your regular weekly, biweekly or monthly payment. Web an amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. A portion of each payment is for interest while the remaining amount is. Web printable amortization schedule pdf & excel to calculate your monthly mortgage or loan payments. It is basically a table that determines the principal amount and amount of interest compromising each payment. Web an amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator. Whatever payment option you choose, amortization ensures that your interest and principal balance is reduced to zero once your loan term ends. Web loan payment calculator with amortization schedule. Web use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan.

Monthly Principal & Interest $1,163

Download balloon loan amortization schedule template excel | smartsheet Web what exactly is an amortization schedule? Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments. Web an amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator.

Web An Amortization Schedule With Fixed Monthly Payment And Balloon Excel Works On The Same Software As The Online Printable Amortization Schedule Pdf.

Web amortization schedule is an amortization calculator used to calculate mortgage or loan payments and generates a free printable amortization schedule with fixed monthly payment and amortization chart. Web use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. Web click on calculate and you’ll see a dollar amount for your regular weekly, biweekly or monthly payment. Web printable amortization schedule pdf & excel to calculate your monthly mortgage or loan payments.

Web Organizing Is Hard, So Make A List Of Each Payment On Your Mortgage Over Time With Template.net’s Free Sample Amortization Schedule Template.

You need to enter the required values, and the calculations will be. For a printable amortization schedule, click on the provided button and a new browser window will open. It is basically a table that determines the principal amount and amount of interest compromising each payment. Web what is an amortization schedule?

The Amortization Table Shows How Each Payment Is Applied To The Principal Balance And The Interest Owed.

Web an amortization schedule (sometimes called an amortization table) is a table detailing each periodic payment on an amortizing loan. Web an amortization schedule is a table that lists periodic payments on a loan or mortgage over time, breaks down each payment into principal and interest, and shows the remaining balance after each payment. Create printable amortization schedules with due dates; Web paying loans back involves using an amortization schedule, breaking the loan into equal monthly payments of principal and interest.