Printable Monthly Budget Based On Biweekly Pay Template - How to budget biweekly paychecks in 7 easy steps: Write your first biweekly budget. Web download budgeting your finances is an initial step toward responsible living. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. Because you are only getting 2 paychecks no matter which term is used. Set aside money for savings 4. Make sure you include every single purchase and expense within your ongoing budget. Web a biweekly budget is a budget that takes into account a person collecting a paycheck every 14 days. If you have an expense that does not occur. Check out the best budget templates:

Printable Monthly Budget Based On Biweekly Pay Template Printable

However, this way of doing it has a huge problem for most people: How to budget biweekly paychecks: It assumes that all expenses and all income are made at the same time. Create your monthly spending categories 5. Web list all of your expenses on a calendar.

Pin on How to Budget Your Money

If this budget sheet isn’t right for you, try another tool. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. Check out the best budget templates: Monthly budget planner excel 1.2.2 the 50/30/20 rule 1.2.3 word: Web 1 free budget sheet template 1.1 how to make a budget spreadsheet.

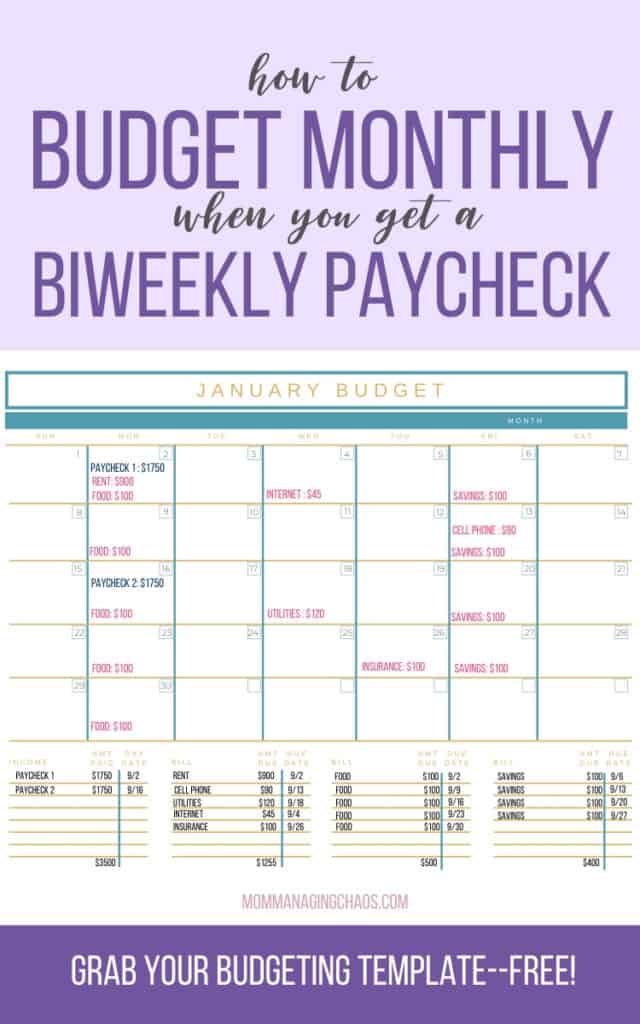

How to Budget BiWeekly Pay + Paying Monthly Bills

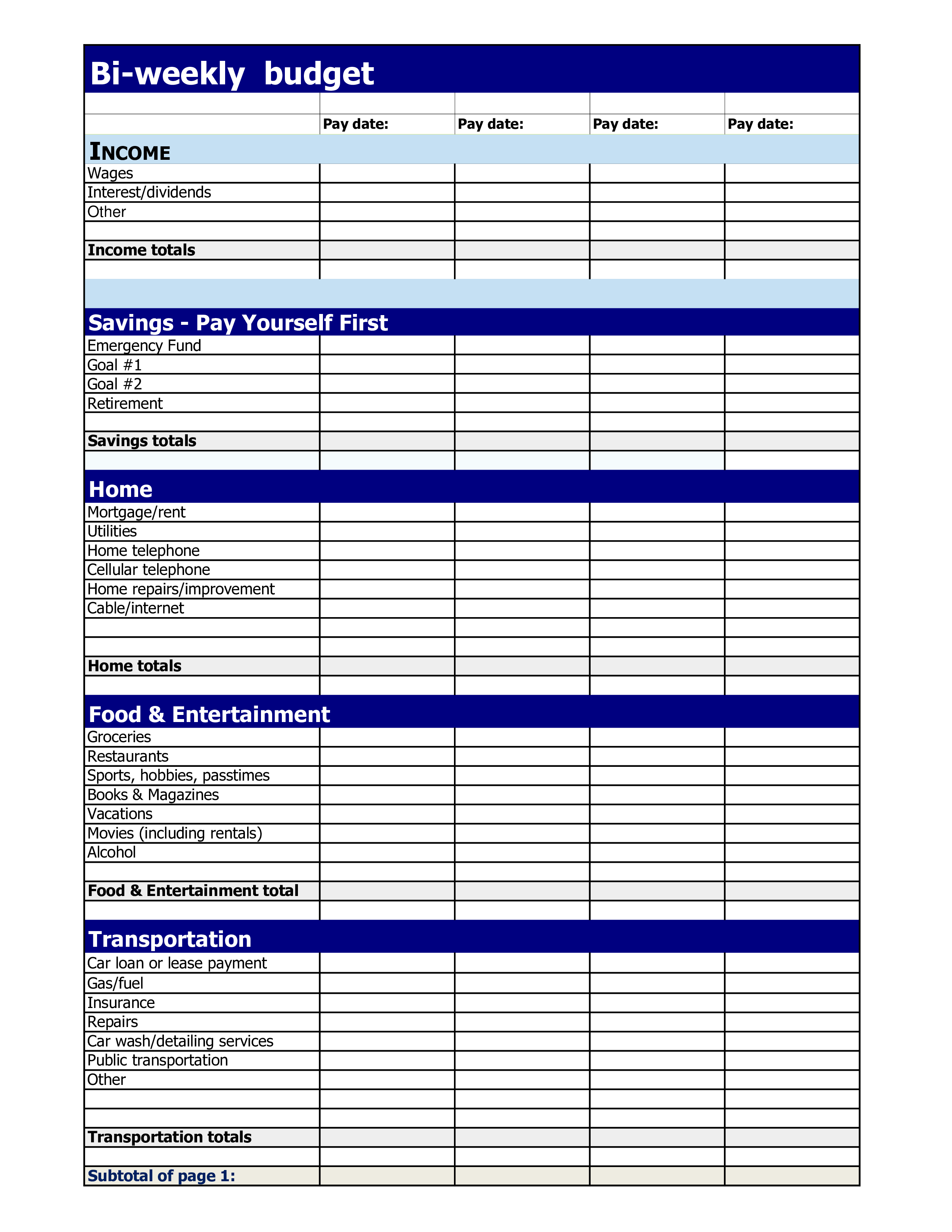

Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. Web biweekly budget template: Create your monthly spending categories 5. 3.1 make an emergency fund 3.2 save for a big goal 3.3 fund much. Personal budget templates keep track of your personal expenses with the simple templates designed for personal.

Bi Monthly Budget Template HQ Template Documents

Make sure you include every single purchase and expense within your ongoing budget. List all your bills 2. Information to help you plan next month’s budget. Web a biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach. It assumes that all expenses and all income are made at the same time.

Biweekly Budget Template Free Printable Printable Templates

The first template is a weekly money manager that allows you to track accounts and record transactions and compare your. Web list all of your expenses on a calendar. When it comes to establishing a budget, these words can get even more confusing. Templates include a household expense budget, holiday budget planner and event budget. However, this way of doing.

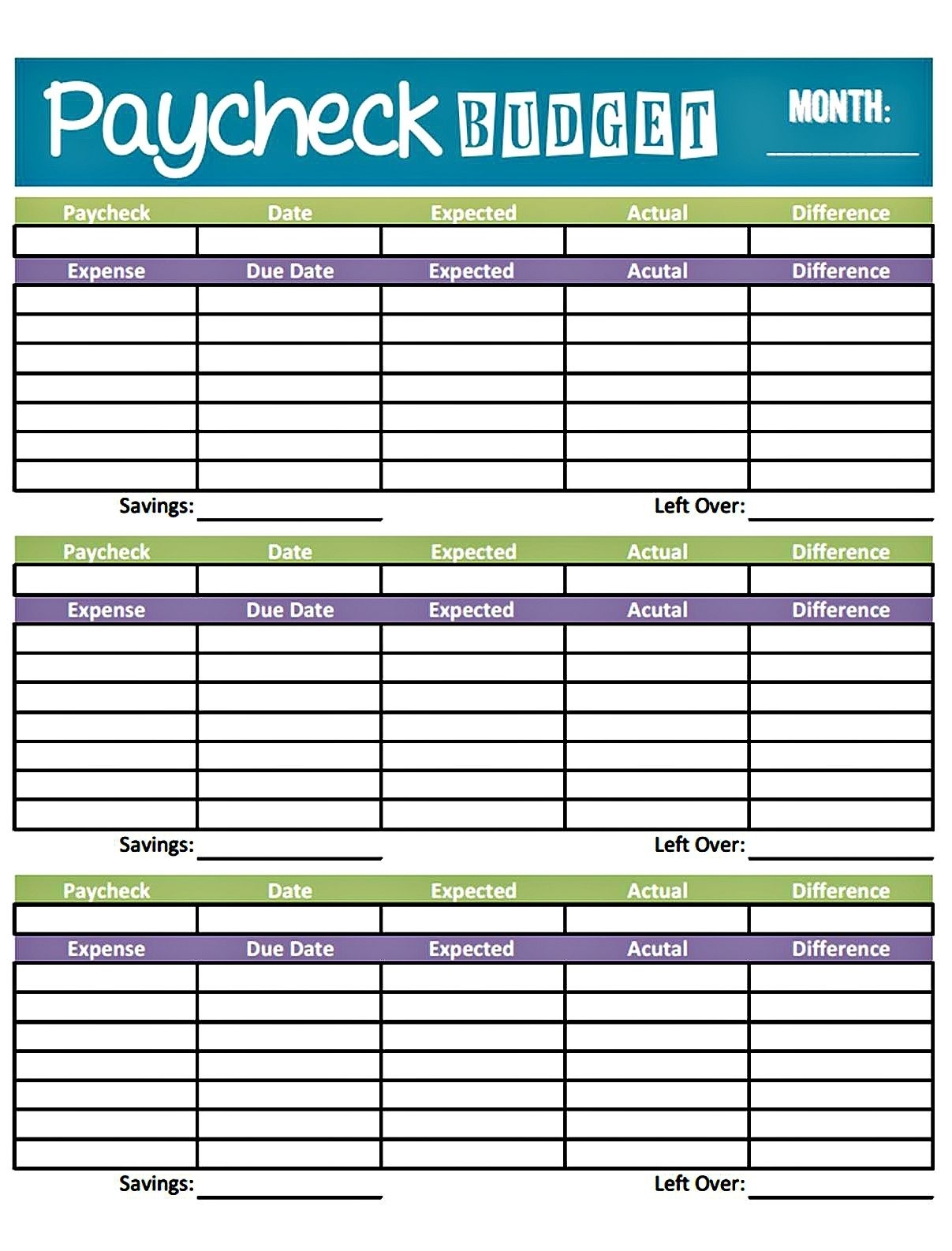

Paycheck to Paycheck Budget Template, ZeroBased Budget Printable

Web make a budget use this worksheet to see how much money you spend this month. Monthly budget planner excel 1.2.2 the 50/30/20 rule 1.2.3 word: Web a biweekly budget is a budget that takes into account a person collecting a paycheck every 14 days. Next, you need to write out all your bills and expenses to see how they.

Biweekly Budget Template Paycheck Budget Budget Printable Etsy in

Setting up a calendar start planning your budget by setting up a calendar. Templates include a household expense budget, holiday budget planner and event budget. If you have an expense that does not occur. Some bills are monthly and some come less often. Web these budgeting worksheets will help you figure out how to budget biweekly, whether you get a.

20 Beautiful Debt Snowball Worksheet Google Docs

When it comes to establishing a budget, these words can get even more confusing. Whether you are living alone, with your family, or with your spouses, even in school and organizations, budgeting finances saves a lot of time and effort in avoiding unnecessary spending. Using it, you can easily plan your fixed budget. How to budget biweekly paychecks: Print out.

Printable Monthly Budget Based On Biweekly Pay Template Printable

You can estimate income and spendings every two weeks. List all your bills 2. Web these budgeting worksheets will help you figure out how to budget biweekly, whether you get a paycheck once, twice, three or four times a month. Create your monthly spending categories 5. Editable monthly budget planner template 2 budget planner book 2.1 planner app:

Free Printable Biweekly Bill Planner Best Calendar Example

The first template is a weekly money manager that allows you to track accounts and record transactions and compare your. When it comes to establishing a budget, these words can get even more confusing. Setting up a calendar start planning your budget by setting up a calendar. Web biweekly budget template: Write your first biweekly budget.

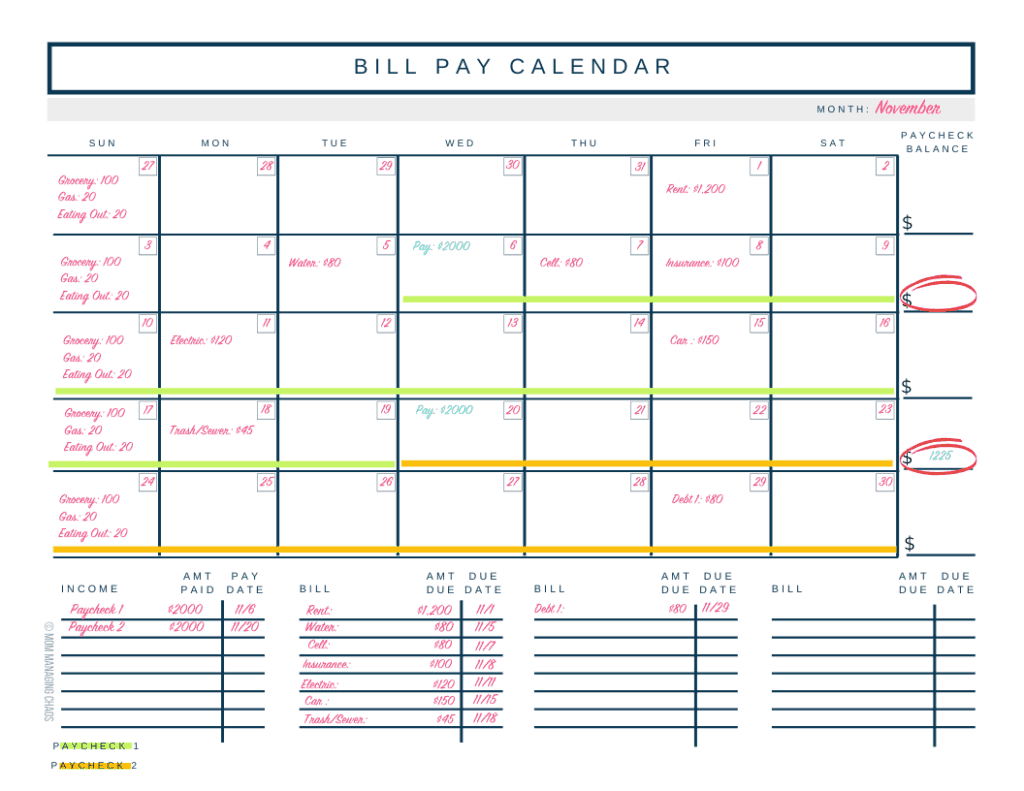

Editable monthly budget planner template 2 budget planner book 2.1 planner app: Fill out a monthly budget calendar 3. Whether you are living alone, with your family, or with your spouses, even in school and organizations, budgeting finances saves a lot of time and effort in avoiding unnecessary spending. Information to help you plan next month’s budget. Be sure to include your regular savings amount, which traditionally is 20 percent of your monthly. Setting up a calendar start planning your budget by setting up a calendar. Print out a monthly calendar similar to the one above and write down what your bills/expenses are, how much they are and when their due dates are. Make sure you include every single purchase and expense within your ongoing budget. Templates include a household expense budget, holiday budget planner and event budget. Moreover, a specified calendar will provide you with a visual image of each and everything that happens during the month. The biweekly and twice per month pay schedules are slightly different as the total number of paychecks per year varies. The first template is a weekly money manager that allows you to track accounts and record transactions and compare your. Create your monthly spending categories 5. List all your bills 2. When it comes to establishing a budget, these words can get even more confusing. Write your first biweekly budget. Web make a budget use this worksheet to see how much money you spend this month. Set aside money for savings 4. Web biweekly budget template: 3.1 make an emergency fund 3.2 save for a big goal 3.3 fund much.

The First Template Is A Weekly Money Manager That Allows You To Track Accounts And Record Transactions And Compare Your.

Web list all of your expenses on a calendar. Set aside money for savings 4. Editable monthly budget planner template 2 budget planner book 2.1 planner app: You can estimate income and spendings every two weeks.

Personal Budget Templates Keep Track Of Your Personal Expenses With The Simple Templates Designed For Personal Use.

How to budget biweekly paychecks in 7 easy steps: List all your bills 2. Web these budgeting worksheets will help you figure out how to budget biweekly, whether you get a paycheck once, twice, three or four times a month. Because you are only getting 2 paychecks no matter which term is used.

Web 1 Free Budget Sheet Template 1.1 How To Make A Budget Spreadsheet 1.2 Monthly Budget Template 1.2.1 Spreadsheet:

Some pay schedules are monthly, weekly, biweekly, and even twice per month. Web download budgeting your finances is an initial step toward responsible living. Using it, you can easily plan your fixed budget. Every month, put it in the “other expenses this month” category.

You Could Apply Budgeting To Almost Everything.

It assumes that all expenses and all income are made at the same time. Next, you need to write out all your bills and expenses to see how they will line up with your biweekly budget! If you have an expense that does not occur. Make sure you include every single purchase and expense within your ongoing budget.