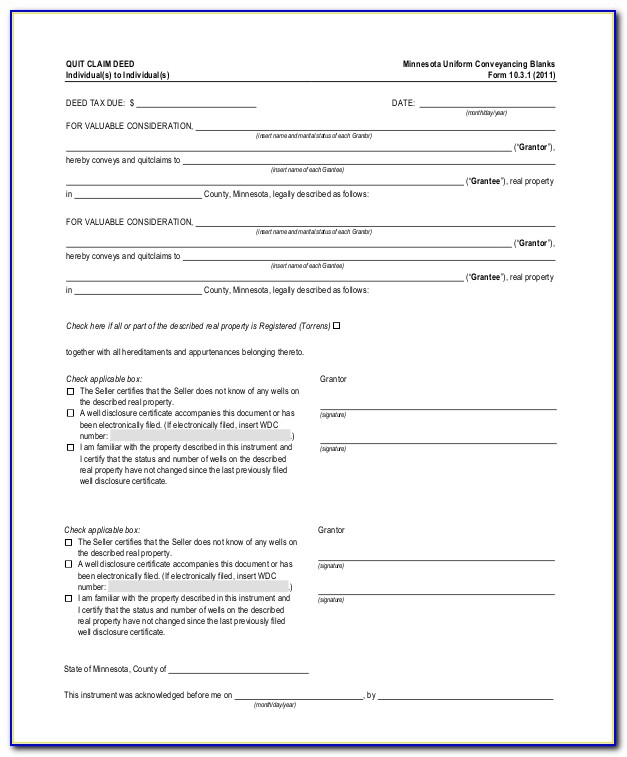

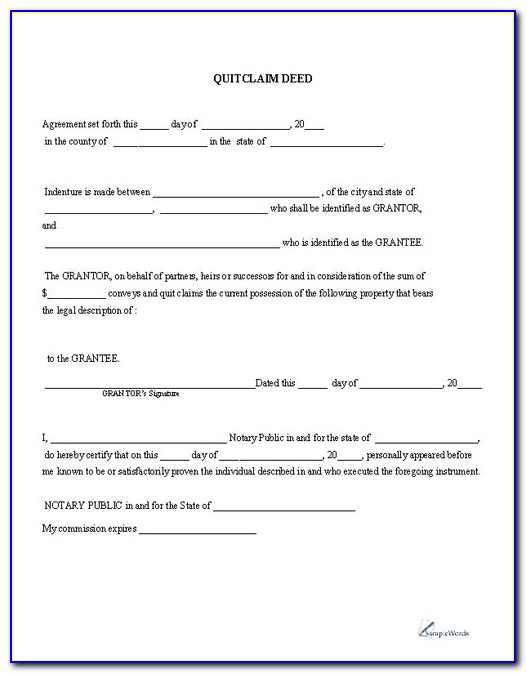

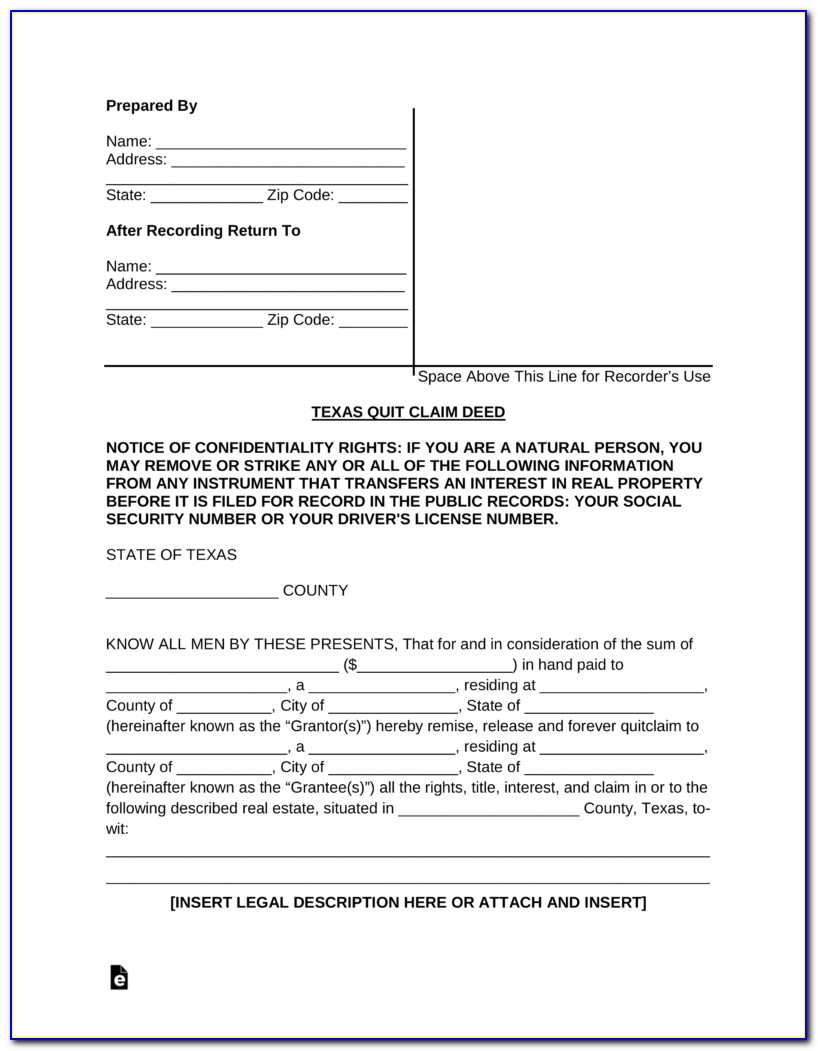

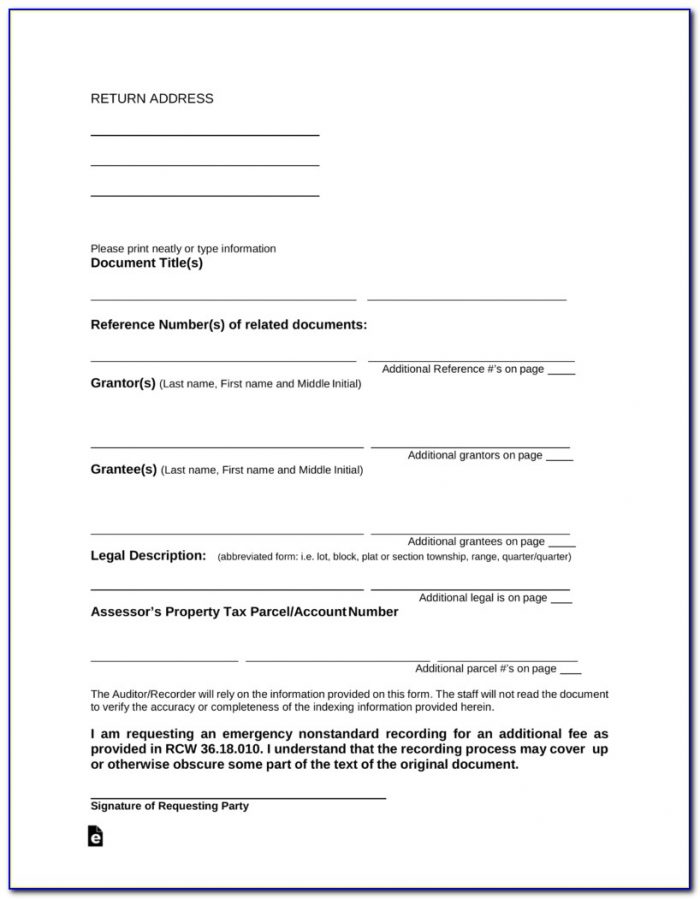

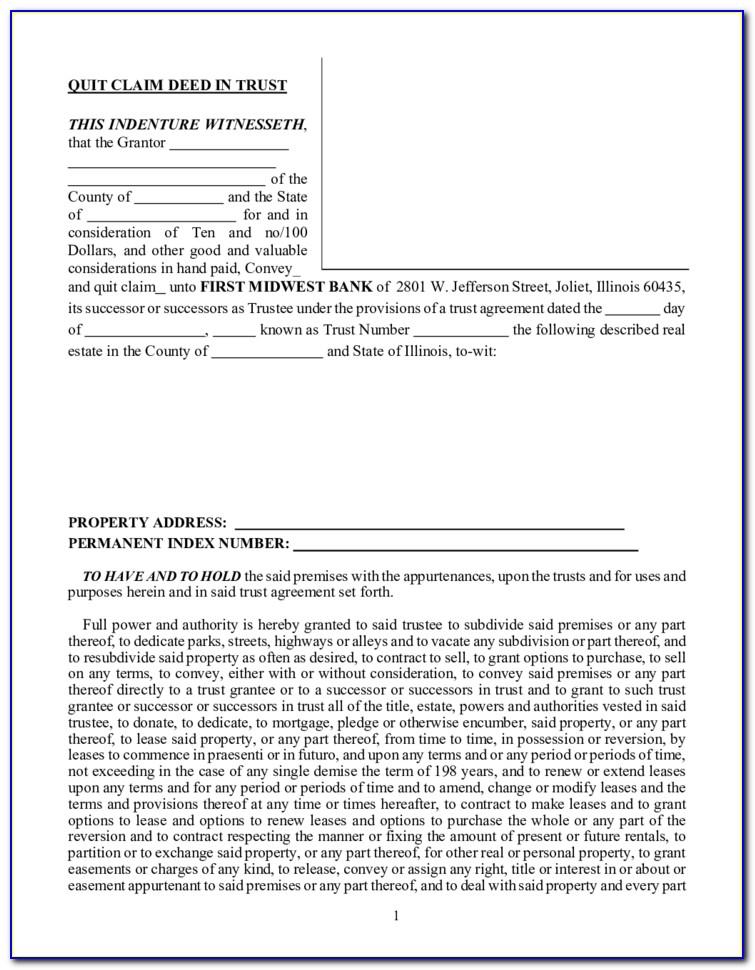

Printable Quit Claim Deed Form Free Illinois - Web illinois quit claim deed form author: A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). 765 ilcs 5/10 contains the basic statutory form and requirements for a quitclaim deed. Known as the “transfer tax declaration”, this is a form (and accompanying payment) that must be completed prior to recording the deed, per the property tax code ( 35 ilcs 200 ). Web quit claim deed illinois statutory mail to: Web illinois quit claim deed information. ____________________ ____________________ ____________________ the grantor(s) ____________________ ____________________ ____________________ ____________________ name & address of tax payer: The illinois quitclaim deed is used to transfer ownership of real estate from one party to another. Quitclaim deed form requirements for illinois.

Quit Claim Deed Forms Illinois Form Resume Examples EAkwlRqDgY

Web illinois quit claim deed form. However, unlike a warranty deed, the seller or grantor is not required to warrant the title to the property he is selling. Thereto including any warranty or merchantability or fitness for a particular. If there are other owners of the property, their percentage share will remain the same. Create document updated may 4, 2023.

Quit Claim Deed Template Illinois Free Download

____________________ ____________________ ____________________ the grantor(s) If there are other owners of the property, their percentage share will remain the same. Web illinois quit claim deed information. A quitclaim conveys all ownership interests of the grantor only. The illinois quitclaim deed is used to transfer ownership of real estate from one party to another.

Free Az Quit Claim Deed Form Form Resume Examples XA5yG1wkpZ

The quit claim deed offers zero protection to the buyer (or receiver). ____________________ ____________________ ____________________ the grantor(s) Web illinois quit claim deed form. The illinois quitclaim deed is used to transfer ownership of real estate from one party to another. A quitclaim conveys all ownership interests of the grantor only.

Quit Claim Deed Individual Form Oklahoma Free Download

This instrument was prepared by: Thereto including any warranty or merchantability or fitness for a particular. A quitclaim conveys all ownership interests of the grantor only. To put the deed into effect, it needs to be brought to the county clerk & recorder’s office. Create document updated may 4, 2023 | legally reviewed by susan chai, esq.

Quit Claim Deed Form Illinois Mchenry County Form Resume Examples

____________________ ____________________ ____________________ the grantor(s) A quitclaim conveys all ownership interests of the grantor only. Web updated june 12, 2023. A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). To put the deed into effect, it needs to be brought to the county clerk.

Quit Claim Deed Form Sangamon County Illinois Universal Network

This instrument was prepared by: Web free illinois quitclaim deed. Web quit claim deed illinois statutory mail to: Quitclaim deed form requirements for illinois. ____________________ ____________________ ____________________ ____________________ name & address of tax payer:

Free Quit Claim Deed Form Illinois Cook County Form Resume Examples

A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). The publisher nor the seller of this form makes any warranty with respect. A quitclaim conveys all ownership interests of the grantor only. ____________________ ____________________ ____________________ ____________________ name & address of tax payer: Thereto including.

Free Illinois Quit Claim Deed Form Word PDF eForms

The quit claim deed offers zero protection to the buyer (or receiver). Consult a lawyer before using or acting under this form. The publisher nor the seller of this form makes any warranty with respect. Quitclaim deed form requirements for illinois. Create document updated may 4, 2023 | legally reviewed by susan chai, esq.

Free Quit Claim Deed Form Missouri Universal Network

765 ilcs 5/10 contains the basic statutory form and requirements for a quitclaim deed. ____________________ ____________________ ____________________ ____________________ name & address of tax payer: Web illinois quit claim deed information. The grantor(s), _____, of the city of _____, county of _____, state of illinois, in This type of deed is most often used when the property is being given as.

Download Ohio Quitclaim Deed Form for Free TidyTemplates

Create document updated may 4, 2023 | legally reviewed by susan chai, esq. A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). The grantor(s), _____, of the city of _____, county of _____, state of illinois, in Web updated june 12, 2023. Web illinois.

Web free quitclaim deed form use our quitclaim deed to release your rights and ownership claims over property you’re selling or gifting. The illinois quitclaim deed is used to transfer ownership of real estate from one party to another. To put the deed into effect, it needs to be brought to the county clerk & recorder’s office. Web updated june 12, 2023. The quit claim deed offers zero protection to the buyer (or receiver). The publisher nor the seller of this form makes any warranty with respect. ____________________ ____________________ ____________________ the grantor(s) Web illinois quit claim deed form author: Create document updated may 4, 2023 | legally reviewed by susan chai, esq. Quitclaim deed form requirements for illinois. The grantor(s), _____, of the city of _____, county of _____, state of illinois, in However, unlike a warranty deed, the seller or grantor is not required to warrant the title to the property he is selling. This instrument was prepared by: Known as the “transfer tax declaration”, this is a form (and accompanying payment) that must be completed prior to recording the deed, per the property tax code ( 35 ilcs 200 ). ____________________ ____________________ ____________________ ____________________ name & address of tax payer: 765 ilcs 5/10 contains the basic statutory form and requirements for a quitclaim deed. If there are other owners of the property, their percentage share will remain the same. Web illinois quit claim deed form. Web free illinois quitclaim deed. Web quit claim deed illinois statutory mail to:

The Publisher Nor The Seller Of This Form Makes Any Warranty With Respect.

Thereto including any warranty or merchantability or fitness for a particular. The grantor(s), _____, of the city of _____, county of _____, state of illinois, in Consult a lawyer before using or acting under this form. Known as the “transfer tax declaration”, this is a form (and accompanying payment) that must be completed prior to recording the deed, per the property tax code ( 35 ilcs 200 ).

The Illinois Quitclaim Deed Is Used To Convey Real Estate In Illinois From One Party To Another.

Quitclaim deed form requirements for illinois. The quit claim deed offers zero protection to the buyer (or receiver). This instrument was prepared by: If there are other owners of the property, their percentage share will remain the same.

To Put The Deed Into Effect, It Needs To Be Brought To The County Clerk & Recorder’s Office.

This type of deed is most often used when the property is being given as a gift. A quit claim deed, or “quitclaim,” transfers the ownership and rights of a property with no guarantees from a grantor (“seller”) to a grantee (“buyer”). Web quit claim deed illinois statutory mail to: Web free illinois quitclaim deed.

Web Illinois Quit Claim Deed Information.

Create document updated may 4, 2023 | legally reviewed by susan chai, esq. A quitclaim conveys all ownership interests of the grantor only. Web illinois quit claim deed form. ____________________ ____________________ ____________________ ____________________ name & address of tax payer: