Tax Form 8962 Printable - Form 8962, premium tax credit Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)? This form is for income earned in tax year 2022, with tax returns due in april 2023. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web get the tax form 8962 printable template ️📝 a step by step guide with ☑️ best examples ☑️ blank templates ☑️ online filling form for irs 8962 and all extentions! Web what is irs form 8962: Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Decide on what kind of esignature to create. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Web what is irs form 8962: Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Open the downloaded pdf and navigate to your form 8962 to print it. Web how to print 8962 form here are the blank template in pdf and doc..

Where Can I Pick Up Irs Forms And Instructions Darrin Kenney's Templates

Reminders applicable federal poverty line percentages. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. You may take ptc (and aptc may be paid).

Irs Fax Number For 8962 2020 Fill and Sign Printable Template Online

Irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for. What is a 8962.

IRS Form 8962 Understanding Your Form 8962

A typed, drawn or uploaded signature. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web form 8962, premium tax credit if you.

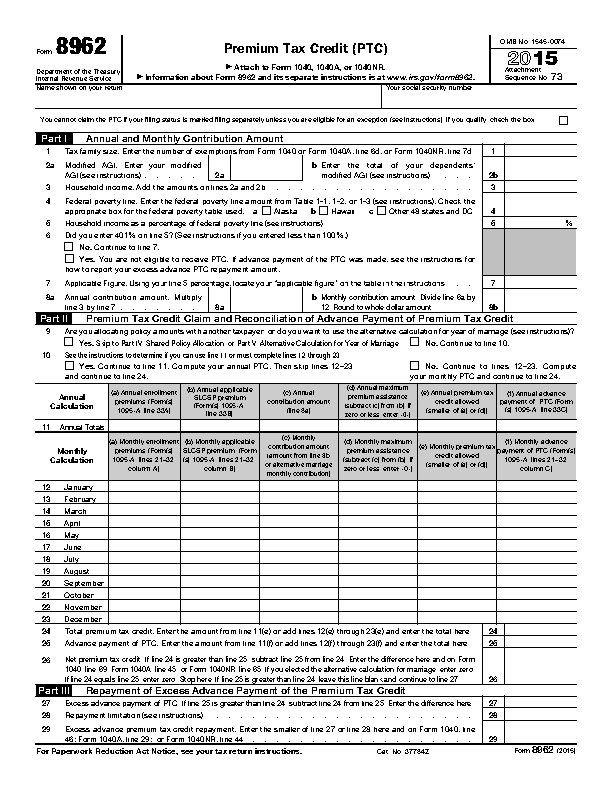

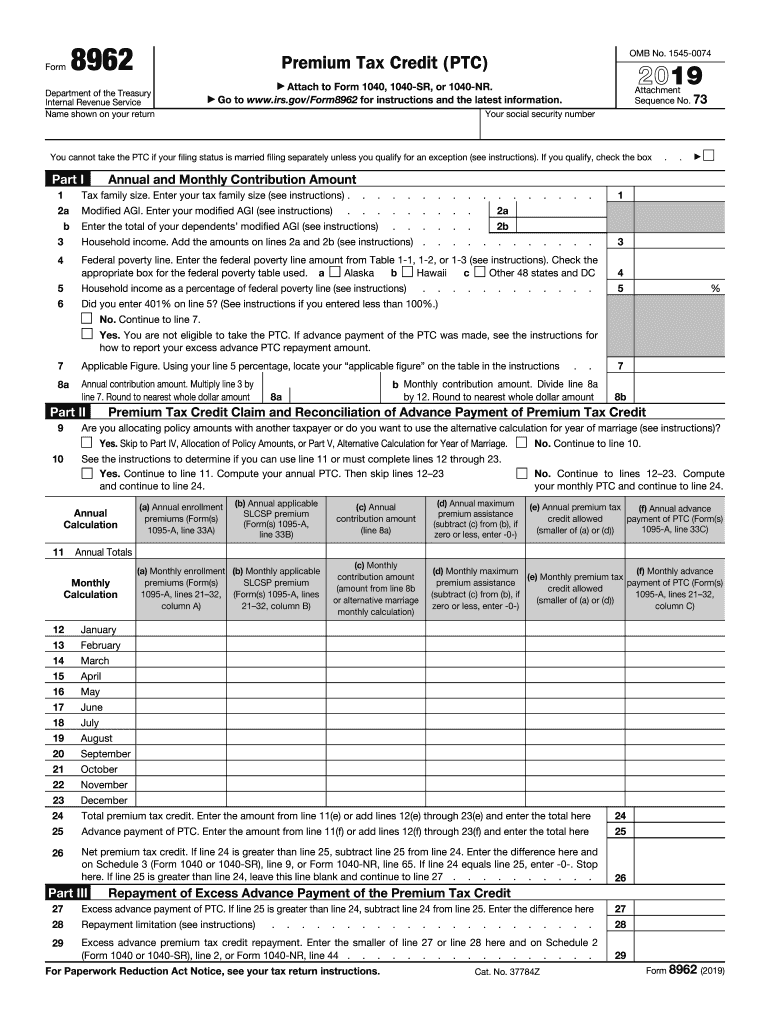

Best IRS 8962 For 2015 (US) 2019 Update FormsPro.io

Irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. Reminders applicable federal poverty line percentages. While it uses the amend process to prepare the 8962, you do not send the form 1040x (amended reutrn) to the.

IRS Form 8962 2016 Irs forms, Number forms, Irs

Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit..

Free Fillable 8962 Form Printable Forms Free Online

After that, your irs form 8962. Select the information you need to get details: 73 name shown on your return your social security number a. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. We will update this.

How To Fill Out Form 8962 laurasyearinhongkong

Send the following to the irs address or fax number given in your irs letter: Web a list of all the tax deductions and tax credits claimed in the tax return. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. If you believe that this page should be.

Instructions for Form 8962 for 2018 KasenhasLopez

Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Open the downloaded pdf and navigate to your form 8962 to print it. Web get printable & fillable irs form 8962 sample for 2020 ☑️ how to fill out form 8962 instructions ☑️ all.

Form 8962 Edit, Fill, Sign Online Handypdf

Web how to print 8962 form here are the blank template in pdf and doc. Reminders applicable federal poverty line percentages. Irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. Create your esignature and click ok..

While it uses the amend process to prepare the 8962, you do not send the form 1040x (amended reutrn) to the irs. Any other documents requested by the irs (for example, a copy of the foreign tax return or a foreign bank statement). Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Ensure the security of your data and transactions. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. You can print other federal tax forms here. You may take ptc (and aptc may be paid) only for health insurance coverage in a qualified health plan (defined later) purchased through a health insurance marketplace (marketplace, also known as an exchange). Irs form 8962 2021 printable; Open the downloaded pdf and navigate to your form 8962 to print it. Go to www.irs.gov/form8962 for instructions and the latest information. Web how to print 8962 form here are the blank template in pdf and doc. Send the following to the irs address or fax number given in your irs letter: Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962. Create your esignature and click ok. Web get the tax form 8962 printable template ️📝 a step by step guide with ☑️ best examples ☑️ blank templates ☑️ online filling form for irs 8962 and all extentions! Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Select the information you need to get details:

Any Other Documents Requested By The Irs (For Example, A Copy Of The Foreign Tax Return Or A Foreign Bank Statement).

Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit. A typed, drawn or uploaded signature. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year.

You May Take Ptc (And Aptc May Be Paid) Only For Health Insurance Coverage In A Qualified Health Plan (Defined Later) Purchased Through A Health Insurance Marketplace (Marketplace, Also Known As An Exchange).

73 name shown on your return your social security number a. If you believe that this page should be taken down, please follow our dmca take down processhere. Form 8962 blank template to print & fill out before file. Select the document you want to sign and click upload.

Enrollment Premiums Second Lowest Cost Silver Plan (Slcsp) Premium Advance Payment Of Premium Tax Credit Complete All Sections Of Form 8962.

Web form 8962, premium tax credit if you had marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Irs 8962 is the form that was made for taxpayers who want to find out the premium tax credit amount and to reconcile this figure with advance payment of the premium tax credit. Web what is irs form 8962:

Web Information About Form 8962, Premium Tax Credit, Including Recent Updates, Related Forms And Instructions On How To File.

After that, your irs form 8962. Reminders applicable federal poverty line percentages. Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through. Web 01 fill and edit template 02 sign it online 03 export or print immediately what is a 8962 form (2022)?

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)